Understanding the Realtor-Homebuyer Relationship and Realtor Commission in Dallas: How it works and What You Need to Know

Hello there, future homeowners in the Dallas area! Suppose you’re gearing up to step into the exciting world of Dallas real estate.

In that case, you’ve probably wondered if you need to hire a Realtor and, if you do, what the relationship between Realtors and homebuyers looks like.

Let me tell you, It’s like a dance that, when performed well, leads to a successful and mutually beneficial outcome.

In this guide, I’ll help you understand the dynamics of working with a Realtor so that you can navigate your home-buying journey with confidence and clarity.

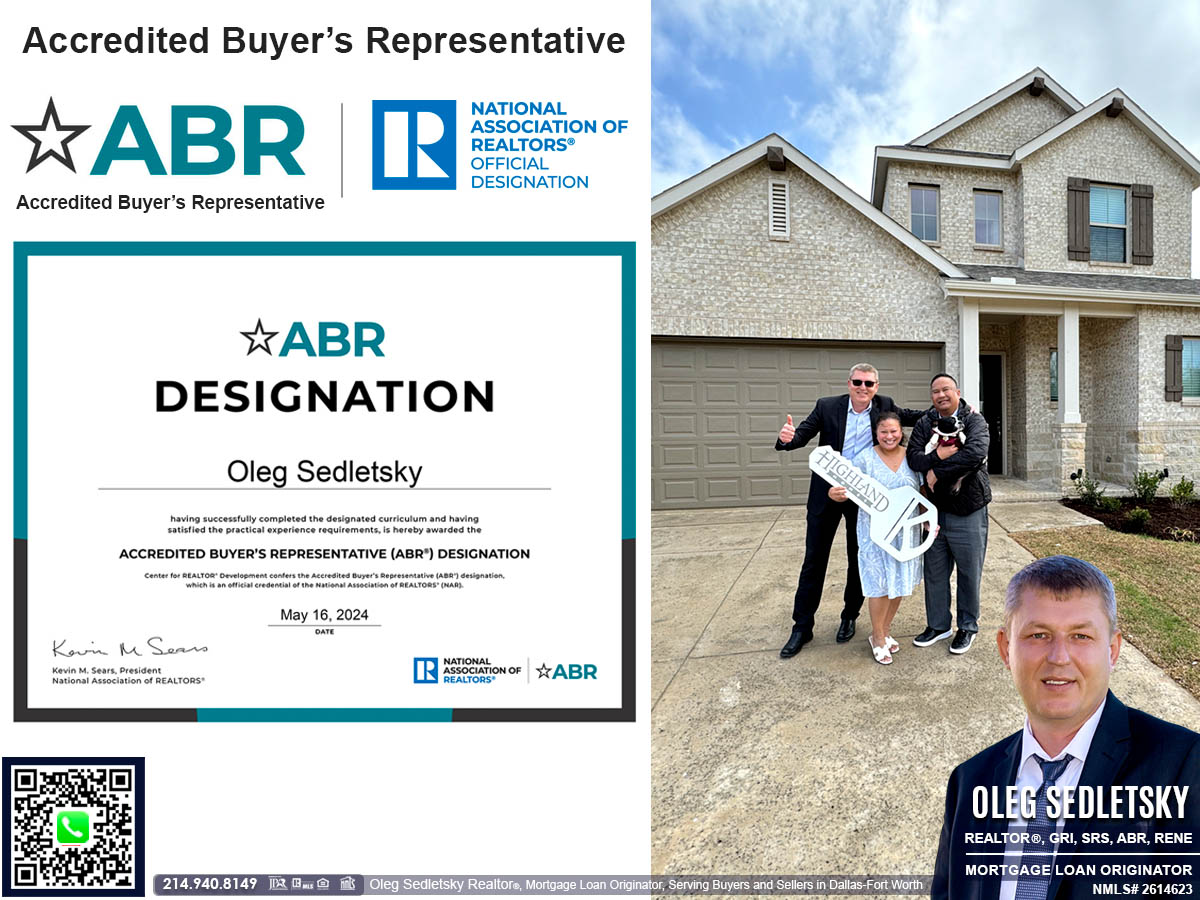

Shown in the photo: Oleg Sedletsky, a Realtor located in the Dallas-Fort Worth area, is meeting with clients at their newly constructed home.

Table of contents:

The importance of understanding real estate representation

How agency laws in Texas affect unrepresented homebuyers

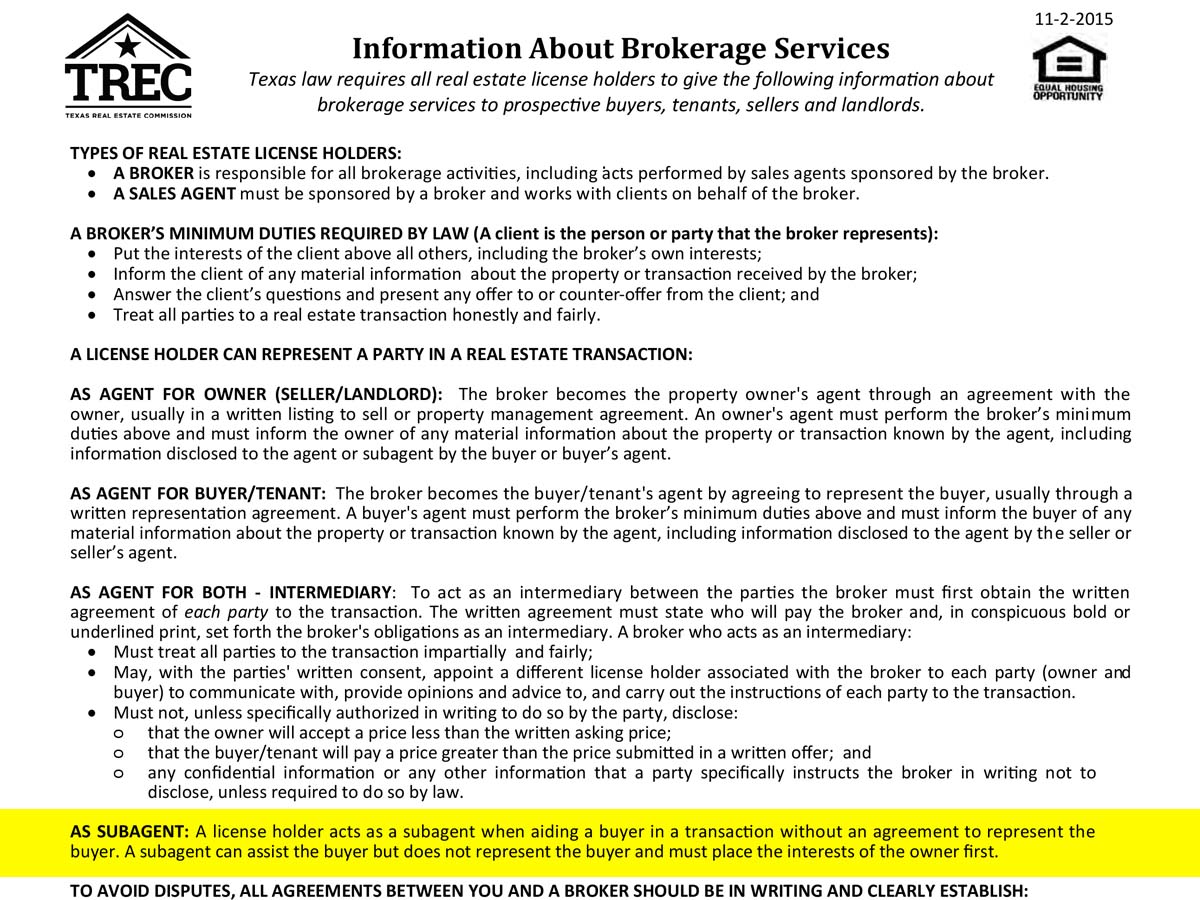

The Information About Brokerage Service (IABS): What Is It? Why You need to see it?

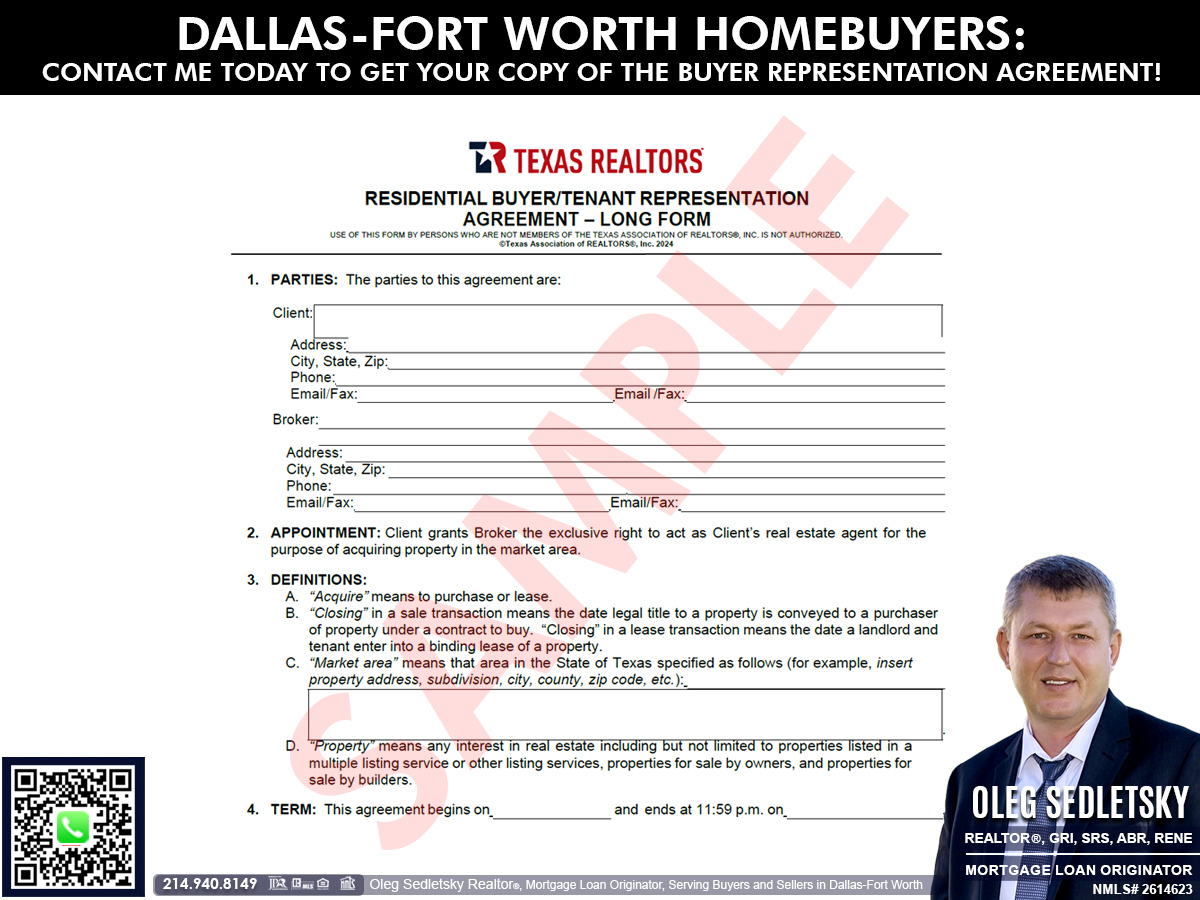

Buyer Representation Agreement: What It Is and Why It Matters

When is the best time to hire a Realtor

Can a homebuyer avoid dealing with Realtor and do business directly with the seller?

What documents need to be signed and what else is required to hire a Realtor in Dallas

Realtor Compensation Explained

What happens when you make your initial contact with a Realtor? Does this means that the Realtor is already working on your behalf?

Picture this: You reached out to a Realtor, excited to start checking out homes. You had nice conversation, asked some questions and maybe even requested assistance in finding a home or getting specific information about your home search. After that, You might assume that after your initiall contact a Realtor automatically obliged to represent you and act in your best interest. Guess what? That’s not how it works!

IT IS CRUCIAL TO RECOGNIZE THAT A MERE PHONE CALL OR EMAIL CONVERSATION WITH A REALTOR DOES NOT AUTOMATICALLY ESTABLISH A BUYER REPRESENTATION.

At this stage, the Realtor isn’t exclusively working for you and doesn’t have any obligations to help you.

It’s only with a signed Buyer Representation Agreement that the Realtor has the right and responsibilities to represent you, the homebuyer.

It is important to consider that Realtors operate within a business context and their time holds significant value. Without a signed Buyer Representation Agreement, dealing with a customer who hasn’t committed to hiring a specific Realtor can result in a considerable waste of time. This time could be better spent focusing on a client who is committed and has already engaged a Realtor for representation, having completed all necessary paperwork. Put yourself in the Realtor’s shoes: would you willingly cater to someone who isn’t interested in conducting business with you?

Shown in the photo: Oleg Sedletsky, a Realtor based in Dallas-Fort Worth, engaging in a phone conversation with clients regarding an available new construction home in Princeton, TX.

How agency laws in Texas affect unrepresented homebuyers.

Just so you know, according to Texas law, a real estate agent needs to represent at least one side of the transaction. This means that without a signed Buyer Representation Agreement, the agent has to represent sellers by default when discussing a particular property. And trust me, the sellers have completely different interests compared to the homebuyer.

Here’s a quote from IABS: “A license holder acts as a subagent when assisting a buyer without an agreement to represent them. A subagent can help the buyer but doesn’t represent them and must prioritize the interests of the owner.”

It’s like being in a relationship without any commitment; having your relationship status as ‘it’s complicated’ is hardly ideal when purchasing a home, wouldn’t you agree?

Information About the Brokerage Service (IABS): What Is It? Why You need to see it?

In Texas, it’s the law for real estate brokers and sales agents to give written notice about brokerage services at the first meaningful interaction with potential buyers, tenants, sellers, and landlords regarding specific real property.

It provides information to help you understand how realtor services work in Texas. The goal is to give you the information you need to make an informed decision.

Here’s what the IABS is all about:

A BROKER’S MINIMUM DUTIES REQUIRED BY LAW

TYPES OF REAL ESTATE LICENSE HOLDERS

TO AVOID DISPUTES, ALL AGREEMENTS BETWEEN YOU AND A BROKER SHOULD BE IN WRITING AND CLEARLY ESTABLISH duties, responsibilities and obligations of the parties.

LICENSE HOLDER CONTACT INFORMATION

You can grab the IABS from the TREC website or check it out here. Also, it’s a good idea to get familiar with the Consumer Protection Notice while you’re at it.

https://www.trec.texas.gov/forms/information-about-brokerage-services

https://www.trec.texas.gov/forms/consumer-protection-notice

Here is my IABS

Buyer Representation Agreement: What It Is and Why It Matters

Signing a Buyer Representation Agreement is a bit like going steady – it means I’m officially your Realtor, committed to putting your interests first and helping you through the maze of listings, negotiations, and paperwork.

This agreement is more than a piece of paper; it outlines our professional relationship, setting expectations, and establishing a foundation of trust – the cornerstone of any great partnership.

Texas Realtor Compensation Explained

Let’s talk about what’s on everyone’s mind – money. You might wonder how Realtors like me earn our keep.

It all circles back to commissions that are part of the property’s sale price. However, this isn’t a one-size-fits-all scenario. Some real estate agents work on flat fees, hourly rates, or other creative compensation structures.

This flexibility allows you to find services that align with both your needs and your budget.

The Commission Structure

Diving deeper into the commission puzzle, you should know THERE’S NO STANDARD REALTOR COMMISSION IN TEXAS.

I’ll work with you to come up with a commission that feels fair and aligns with the level of service I provide.

Like the ever-changing Texas weather, commission rates can fluctuate due to market conditions and supply and demand. It’s all about finding the sweet spot that works for us both.

Cooperative Compensation in Real Estate

The concept of cooperative compensation is a neat little system where the listing broker may share their commission with the buyer’s broker. Think of it as a ‘finder’s fee’ for bringing a ready and willing buyer like you to the table. Participating in the Multiple Listing Service (MLS) sets the stage for this type of teamwork, ultimately benefiting everyone involved, especially you, the buyer.

How Sellers Benefit from Cooperative Compensation

Why would a listing broker agree to split their hard-earned commission? Simple: it’s good for business. By offering cooperative compensation, the seller’s property becomes irresistible to a larger pool of buyers, which could drive up the sale price.

And here’s the kicker for you as a buyer: Most mortgage lenders won’t let commissions pile onto your loan, and believe me, not having to pay your broker out of pocket on closing day is a huge relief for your wallet.

See details about Realtor Compensation directly from Texas Association of Realtors

Frequently asked questions by homebuyers:

When is the best time to hire a Realtor

The ideal time to hire a Realtor is before you begin the house-hunting process. In the fast-paced Dallas real estate market, it’s crucial to have a professional by your side right from the start. An experienced Realtor helps you understand the market trends, identify your must-haves versus nice-to-haves, and set realistic expectations. Their guidance can be invaluable in streamlining your search, helping you to find the perfect property quickly and efficiently, often gaining access to listings before they hit the wider market. Plus, having a Realtor early in the process ensures you’re prepared to move swiftly in this competitive environment when you do find the house you want to call home.

Can a homebuyer avoid dealing with Realtor and do business directly with the seller?

Sure, a homebuyer can bypass a Realtor and approach a seller directly, but there are several pitfalls to this approach.

One important thing to note is that without a Realtor’s expertise, buyers run the risk of overpaying or missing crucial steps in the due diligence process – things that a professional is trained to handle.

Plus, sellers who have a Realtor representing them may not be open to negotiating with an unrepresented buyer.

When you hire a Realtor, you can relax knowing that your interests are well-represented. Having a skilled advocate and negotiator by your side throughout the entire process gives you peace of mind.

What documents need to be signed and what else is required to hire a Realtor in Dallas

To hire a Realtor in Dallas, you’ll need to sign a few important documents which include the Buyer Representation Agreement, outlining the terms of your relationship with your Realtor, and any disclosures pertinent to your real estate transaction.

In addition, you will have to provide proof of mortgage pre-approval or show that you have funds available to buy a home. This not only boosts your credibility as a buyer, but also helps establish a clear price range for your house hunting. Your Realtor might also ask for some additional documents specific to your situation to ensure a smooth and efficient buying process.

Don’t forget to bring a government-issued ID to confirm your identity.

Is Hiring a Realtor in Dallas Worth It?

Here’s the ultimate question: Should you hire a Realtor to buy a home in the Dallas area? The choice is yours!

In the competitive DFW real estate landscape, having a talented Realtor by your side isn’t just a convenience – it’s a strategic advantage that could make all the difference in finding and securing the right home for you and your family.

And let me tell you, as someone who genuinely cares about getting folks into their dream homes, my answer is a big YES. As your Realtor, I’ll be by your side throughout the entire home buying journey, making sure the process is as stress-free as possible.

Shown in the photo: Oleg Sedletsky, a Realtor based in the Dallas-Fort Worth area, is meeting with clients at the actual location where their future home will be built.

Your Realtor Contact Information

Ready to start your journey toward homeownership? Let’s chat! Reach out to me, and together, we’ll make your dream of owning a home in Dallas a thrilling reality. Contact me any time – your key to a new home is just a call or email away.

Shown in the photo: Oleg Sedletsky, a Realtor operating in the Dallas-Fort Worth area, diligently captures the ongoing construction journey of his clients’ new home.

Nothing found.

Hey Home Buyers! Are you excited to experience the joy of homeownership in the vibrant Dallas-Fort Worth area?

Buying a home in the Dallas-Fort Worth area should feel exciting, not overwhelming. Whether you’re eyeing a charming pre-owned house or a fresh new build, I’m here to make the home buying process simple and straightforward.

I’ll be here to answer your questions, handle the details, and make sure everything falls into place. My goal is to help you buy a home that checks all the boxes for you.

Let’s get started. Fill out my quick Homebuyers contact form and I’ll take it from there.

The Buyer’s Agent Duty

READ: Texas Real Estate Commission Information About Brokerage Services

AS AGENT FOR BUYER/TENANT: The broker becomes the buyer/tenant’s agent by agreeing to represent the buyer, usually through a

written representation agreement. A buyer’s agent must perform the broker’s minimum duties above and must inform the buyer of any

material information about the property or transaction known by the agent, including information disclosed to the agent by the seller or

seller’s agent.

A BROKER’S MINIMUM DUTIES REQUIRED BY LAW (A client is the person or party that the broker represents):

– Put the interests of the client above all others, including the broker’s own interests;

– Inform the client of any material information about the property or transaction received by the broker;

– Answer the client’s questions and present any offer to or counter–offer from the client; and

– Treat all parties to a real estate transaction honestly and fairly.

TO AVOID DISPUTES, ALL AGREEMENTS BETWEEN YOU AND A BROKER SHOULD BE IN WRITING AND CLEARLY ESTABLISH:

– The broker’s duties and responsibilities to you, and your obligations under the representation agreement.

– Who will pay the broker for services provided to you, when payment will be made and how the payment will be calculated.

TYPES OF REAL ESTATE LICENSE HOLDERS:

– A BROKER is responsible for all brokerage activities, including acts performed by sales agents sponsored by the broker.

– A SALES AGENT must be sponsored by a broker and works with clients on behalf of the broker.

Latest from Dallas Real Estate Blog

– Texas Homebuyers Tips, Tricks and Lifehacks

– New Construction Homes in Dallas TX

– Mortgages for Homebuyers and Investors in Dallas-Fort Worth

Explore the Perfect Blend of Luxury and Convenience in a New Construction Home in Princeton, TX! It's a 1-story beauty with 1650 sqft, 3 beds, 2 baths, an office, and a 3-car garage.

Hey friends! Suppose you’re thinking about buying a new construction home in the Dallas-Fort Worth area and open to different locations throughout DFW. In that case, I’d like to suggest considering the charming city of Princeton, TX, as a possible destination. There are plenty of reasons why Princeton, TX, is a fantastic location, and you can check out my Princeton Relocation Guide for some cool facts, local attractions, and more.

If you want a fantastic new home, check out this post! Here, I’m featuring a brand new construction home in Princeton, TX, that you can buy or build. Take a look at the floorplan before you visit so you know what to expect.

Featured New Construction Home in Princeton Texas

Let’s dive into the heart of the matter—the home itself. Imagine a single-story residence with a spacious 1,650 square feet of living space. This beauty boasts three bedrooms, two bathrooms, an office for your remote work needs, a substantial three-car garage, and all of this situated on a generous 60×120 lot! With a current asking price of just $365,000, this home isn’t just a steal; it’s a smart investment in your future.

Noteworthy Features – A Closer Look

Exterior Highlights

From the moment you pull up the driveway, this home impresses with its thoughtful touches. Gutters are pre-installed to protect your foundation, a covered porch and patio invite you to enjoy the outdoors in any weather, and the three-car garage provides abundant room for both vehicles and storage, ensuring ample space for all your needs. Step into the very spacious backyard, perfect for gatherings, gardens, or a personal oasis under the Texas stars.

Gutters are pre-installed to protect your foundation in this New Construction Home in Princeton, TX

A covered porch invite you to enjoy the outdoors in any weather in this New Construction Home in Princeton, TX

Enjoy the outdoors on our covered patio, rain or shine!

The three-car garage provides abundant room for both vehicles and storage in this new construction home in Princeton TX

Step into the very spacious backyard, perfect for gatherings, gardens, or a personal oasis under the Texas stars.

Interior Highlights

Step inside, and you’ll be greeted with luxurious vinyl plank floors setting the stage for modern elegance. Every detail, from the higher-grade faucets and door hardware to the exquisite luxury tile in the showers, reflects a commitment to quality. The kitchen shines with stunning quartz countertops, a gas range for the aspiring chef, and an under-mount sink nestled in a large island. The electric fireplace in the living room adds a touch of warmth and ambiance, and the bay windows in the primary bedroom provide a tranquil retreat with plenty of natural light.

You’ll be greeted with luxurious vinyl plank floors setting the stage for modern elegance in this New Construction Home in Princeton, TX.

Every detail, from the higher-grade faucets and door hardware to the exquisite luxury tile in the showers, reflects a commitment to quality

The bay windows in the primary bedroom provide a tranquil retreat with plenty of natural light

The kitchen shines with stunning quartz countertops, a gas range for the aspiring chef, and an under-mount sink nestled in a large island.

The electric fireplace in the living room adds a touch of warmth and ambiance in this New Construction Home in Princeton, TX.

How to Make It Yours

If you love this floorplan and are considering moving to Princeton, TX, contact me ASAP. I can help you buy this exact floorplan or something similar in an awesome master-planned community. Whether you want a virtual or in-person tour of the home, I’m here to assist you. Oh, and by the way, there might be some builder incentives available to give you a little financial boost with your purchase! So, what are you waiting for? Get in touch with me, your Princeton, TX, Realtor, and let’s kickstart your homebuying journey today!

Some thoughts on the Princeton, TX, real estate market…

Princeton’s housing market is thriving, and homes are selling quickly. Don’t wait too long if you’re considering buying a new construction home. You would want to take advantage of some fantastic opportunities!

If this home has piqued your interest, let’s get moving!

IMPORTANT DISCLOSURES

Just so you know, The price and availability might change without notice. The information presented here is reliable, but it’s always a good idea to double-check.

Reach out to your Realtor for more details, updates, and availability.

A Snapshot Fiesta: Unveiling the Picture-Perfect New Home in Princeton, TX! 📸✨

Unlock Exceptional Service!

Assistance with all your real estate needs in the Dallas-Fort Worth area is just a click or call away. Reach out at 214-940-8149 or connect through the links below.

Greetings! I’m Oleg Sedletsky, and I’m excited to introduce myself as your go-to full-time licensed Texas REALTOR® and Mortgage Loan Originator.

I proudly represent JPAR® – Real Estate Brokerage as a REALTOR® and Utopia Mortgage LLC as a Mortgage Loan Originator! My designations and certifications reflect my dedication to helping you achieve your real estate goals in Princeton, TX and other locations in the vibrant Dallas-Fort Worth area!

My commitment to ongoing professional development means I’m always enhancing my skills to serve you better. You can count on me as your trusted expert throughout your real estate journey. Plus, I’m fluent in English, Ukrainian, and Russian and ready to assist you every step of the way!

It’s All About You and Your Real Estate Goals!

My mission is to serve you! With my knowledge and expertise, I’m here to help you achieve all your real estate goals!

I’m passionate about helping buyers and sellers navigate the exciting real estate landscape in Princeton, Texas! Whether you’re searching for your dream home, exploring land options, or looking for commercial properties, my Real Estate Services have you covered.

Contact me today for all your real estate needs in Princeton, Texas! Call/text 214-940-8149

Dallas Housing Market: Prices | Trends | December 2023

Housing Report for Dallas-Fort Worth-Arlington Metropolitan Statistical Area – December 2023

Single-Family Homes SUMMARY

Sales volume for single-family homes decreased 3.95% YoY from 6,328 to 6,078 transactions.

Year-to-date sales reached a total of 84,438 closed listings.

Dollar volume rose from $2.92 billion to $3 billion.

The average sales price rose 7.06% YoY from $461,330 to $493,882,

The average price per square foot subsequently rose from $197.15 to $203.57.

Median price rose 0.78% YoY from $387,000 to $390,000,

The median price per square foot also rose from $189.63 to $191.49.

Months inventory for single-family homes rose from 2.2 to 2.5 months supply.

Days to sell declined from 90 to 88.

—

(Days to Sell = Days on Market + Days to Close)

(YoY – Year-over-Year is a calculation commonly used in economics or financial data to show how information from one time period compares to the year prior. )

Dallas-Fort Worth Housing Report December 2023 (single family homes residential)

December 2023 | YoY %

Home Sales: 6,078 | -3.95%

Dollar Volume: $3,001,814,002 | 2.83%

Median Close Price: $390,000 | 0.78%

New Listings: 5,939 | 8.87%

Active Listings: 17,855 | 6.96%

Months Inventory: 2.5 | 14.16%

Days to Sell: 88 | -2.22%

Average Price PSF: $203.57 | 3.25%

Median Price PSF: $191.49 | 0.98%

Median Square Feet: 2,117 | 0.76%

Close to Original List Price: 94.66% | 1.11%

COLLIN COUNTY HOUSING REPORT – December 2023

December 2023 | YoY %

New Listings: 990 | + 15.0%

Average Sales Price: $569,839 | + 3.5%

Median Sales Price: $476,000 | – 2.9%

Days on Market Until Sale: 49 | + 2.1%

Inventory of Homes for Sale: 2,557 | – 11.4%

Months Supply of Inventory: 2.0

Relocating to Dallas-Fort Worth?

Consider New Construction Homes in Celina, Texas

Celina, TX is located in Collin County Texas and is part of Dallas-Fort Worth metropolitan area.

About the data used in this report

Data used in Dallas-Fort Worth- Arlington report come from Texas Realtor® Data Relevance Project, a partnership between the Texas Association of Realtors® and local Realtor® associations throughout the state. The analysis is provided through a research agreement with the Real Estate Center at Texas A&M University

Data used in Collin County report come from North Texas Real Estate Information Services, Inc.

You may also be interested in:

Latest from Dallas Real Estate Blog

– Texas Homebuyers Tips, Tricks and Lifehacks

– New Construction Homes in Dallas TX

– Texas Home Sellers Tips, Tricks and Lifehacks

– Mortgages for Homebuyers and Investors in Dallas-Fort Worth

Dallas-Fort Worth Relocation Guide

Explore an important information for Home Sellers in the Dallas-Fort Worth area

Explore an important information for Home Buyers in the Dallas-Fort Worth area

2025

Dallas-Fort Worth Housing Market – Collin County Housing Market: Prices and Trends | January 2025

Dallas-Fort Worth Housing Market – Collin County Housing Market: Prices and Trends | February 2025

Dallas-Fort Worth Housing Market – Collin County Housing Market: Prices and Trends | March 2025

Dallas-Fort Worth Housing Market – Collin County Housing Market: Prices and Trends | April 2025

Dallas-Fort Worth Housing Market – Collin County Housing Market: Prices and Trends | May 2025

Dallas-Fort Worth Housing Market – Collin County Housing Market: Prices and Trends | June 2025

Dallas-Fort Worth Housing Market – Collin County Housing Market: Prices and Trends | July 2025

Dallas-Fort Worth Housing Market – Collin County Housing Market: Prices and Trends | August 2025

Dallas-Fort Worth Housing Market – Collin County Housing Market: Prices and Trends | September 2025

Dallas-Fort Worth Housing Market – Collin County Housing Market: Prices and Trends | October 2025

Dallas-Fort Worth Housing Market – Collin County Housing Market: Prices and Trends | November 2025

Dallas-Fort Worth Housing Market – Collin County Housing Market: Prices and Trends | December 2025

2024

Dallas-Fort Worth Housing Market: Prices and Trends | December 2024

Dallas-Fort Worth Housing Market: Prices and Trends | November 2024

Dallas-Fort Worth Housing Market: Prices and Trends | October 2024

Dallas-Fort Worth Market: Prices and Trends | September 2024

Dallas-Fort Worth Housing Market: Prices and Trends | August 2024

Dallas-Fort Worth Housing Market: Prices and Trends | July 2024

Dallas-Fort Worth Housing Market: Prices and Trends | June 2024

Dallas-Fort Worth Housing Market: Prices and Trends | May 2024

Dallas-Fort Worth Housing Market: Prices and Trends | April 2024

Dallas-Fort Worth Housing Market: Prices and Trends | March 2024

Dallas-Fort Worth Housing Market: Prices and Trends | February 2024

Dallas-Fort Worth Housing Market: Prices and Trends | January 2024

2023

Dallas-Fort Worth Housing Market: Prices and Trends | December 2023

Dallas-Fort Worth Housing Market: Prices and Trends | November 2023

Dallas-Fort Worth Housing Market: Prices and Trends | October 2023

Dallas-Fort Worth Housing Market: Prices and Trends | September 2023

Dallas-Fort Worth Housing Market: Prices and Trends | August 2023

Dallas-Fort Worth Housing Market: Prices and Trends | July 2023

Dallas-Fort Worth Housing Market: Prices and Trends | June 2023

Dallas-Fort Worth Housing Market: Prices and Trends | May 2023

Dallas-Fort Worth Housing Market: Prices and Trends | April 2023

Dallas-Fort Worth Housing Market: Prices and Trends | March 2023

Dallas-Fort Worth Housing Market: Prices and Trends | February 2023

Dallas-Fort Worth Housing Market: Prices and Trends | January 2023

2022

Dallas-Fort Worth Housing Market: Prices and Trends | December 2022

Dallas-Fort Worth Housing Market: Prices and Trends | November 2022

Dallas-Fort Worth Housing Market: Prices and Trends | October 2022

Dallas-Fort Worth Housing Market: Prices and Trends | September 2022

Dallas-Fort Worth Housing Market: Prices and Trends | August 2022

Dallas-Fort Worth Housing Market: Prices and Trends | July 2022

Dallas-Fort Worth Housing Market: Prices and Trends | June 2022

Dallas-Fort Worth Housing Market: Prices and Trends | May 2022

Dallas-Fort Worth Housing Market: Prices and Trends | April 2022

Dallas-Fort Worth Housing Market: Prices and Trends | March 2022

Dallas-Fort Worth Housing Market: Prices and Trends | February 2022

Dallas-Fort Worth Housing Market: Prices and Trends | January 2022

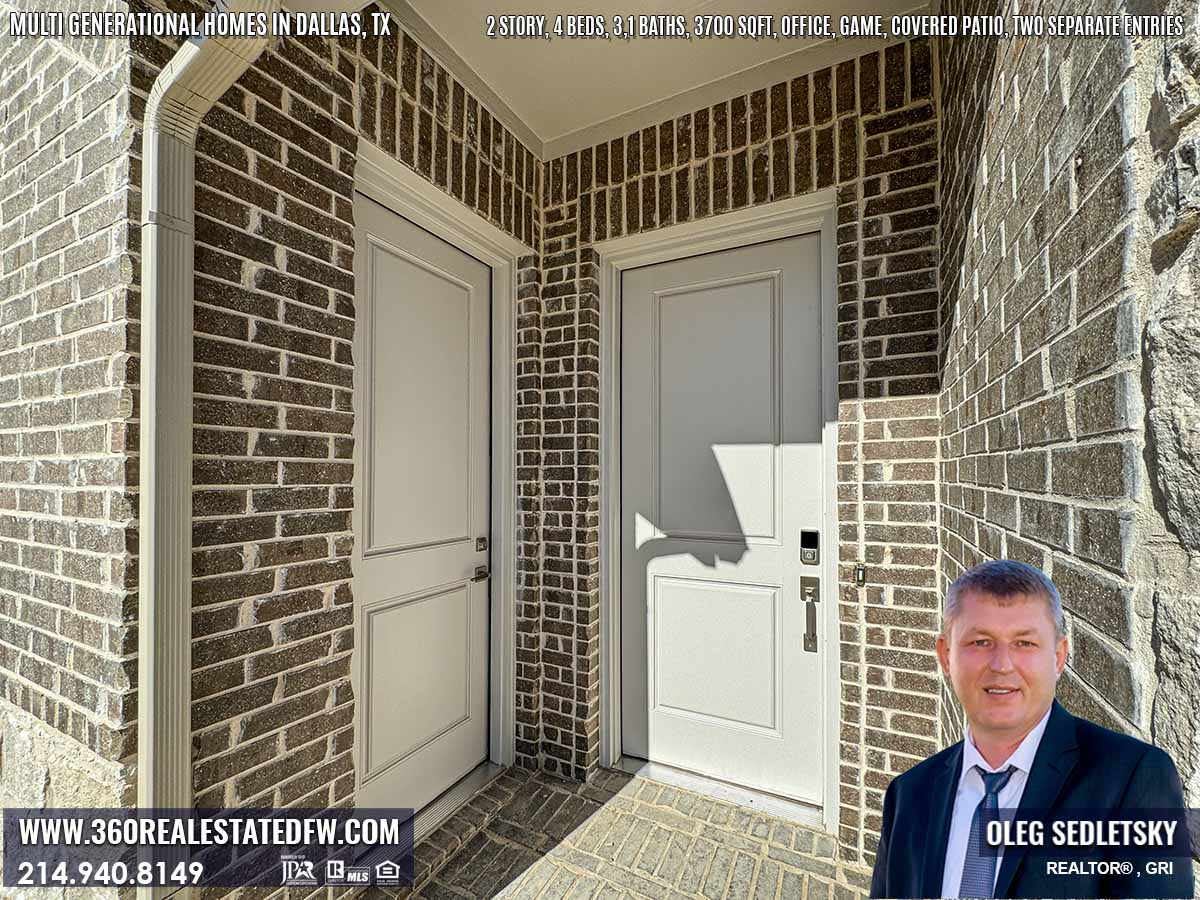

Discover The Excellent New Construction Multi-Generational Home in the Dallas area. It's a 2-story, 3700 SqFt floorplan packed with awesome features.

Hey there! If you’re looking for a multi-generational home in the Dallas area, this post might be just what you need. I recently stumbled upon a fantastic multi-generational floorplan that I’m sure many people will love. This floor plan includes a separate section integrated into the home with its own separate entry. The best part is that you can build or buy this floorplan in multiple locations throughout Dallas-Fort Worth. How cool is that?

What really caught my attention are the numerous incredible features that come standard with this home. Plus, there are a few finish choices available to personalize the interior, so you can make it truly your own.

You Can Buy This Home!

The home showcased in the photos is actually available for sale with an asking price of $570,000, along with available incentives.

If you’re interested in purchasing this multi-generational home or any other similar properties in the Dallas area, please feel free to contact me at your convenience. Let’s work together to make your dream of owning a new home a reality!

Let’s check out the excellent features of this brand-new home!

This spectacular home has a whopping 3700 square feet of living space spread across two stories. It boasts four bedrooms, three and a half bathrooms, an office, a game room, two living areas, and a covered patio.

There are two distinct entrances.

As you approach the home, you’ll be greeted by a charming covered porch. The house boasts two separate entrances, each serving a distinct purpose. The first entrance leads to the main home, featuring a spacious living area and modern amenities. The second entrance grants access to a separate multi-generational section, offering privacy and convenience for extended family or guests.

Multi generational section of the home

The multi-generational area of the house has 1 living area, 1 bedroom and a full bathroom. This specific home doesn’t come with a kitchenette, but you can add that option when building or after buying the home. The first bedroom in the multi-generational section is 10×13 feet, and the second one is 10×11 feet in size.

The foyer

The grand foyer, with its soaring 16-foot-high ceiling, exudes an air of magnificence. As you step inside, your eyes are immediately drawn to the stunning architectural feature—an exquisite opening that connects the foyer to the second floor, creating a sense of openness and elegance.

The Office

The office in this beautiful home is 10×12 feet in size, providing ample space for a productive work environment. The room is adorned with these really cool farm-style Double Barn sliding doors, adding a touch of rustic charm. Moreover, there are two large windows that not only flood the space with natural light but also offer a picturesque view of the frontyard, creating a serene and inspiring atmosphere to work in.

Half Bathroom

The half bathroom, strategically positioned near the office, foyer, and laundry room, offers unparalleled convenience and accessibility for all occupants. Whether you’re rushing to freshen up before an important meeting, greeting guests in the welcoming foyer, Or if you need a brief respite from your household duties, this thoughtfully designed bathroom provides the utmost convenience and ease of use.

Laundry room

The laundry room, thoughtfully positioned right by the entry from the garage, offers the utmost convenience. With its abundant space, it provides ample room for all your laundry needs, making it a functional and practical addition to your home.

Living room

The living room features four large windows that bathe the space in abundant natural light, creating a beautifully illuminated ambiance. With its vaulted ceilings, flush-mounted LED lights, and a stylish ceiling fan, this room offers a perfect blend of elegance and functionality.

Kitchen

The spacious kitchen features a large island with abundant cabinets for ample storage. It also boasts a convenient built-in sink and dishwasher, effortlessly simplifying meal preparation and cleanup.. Pay attention to the luxury of the double oven and high-quality gas range, complete with a sleek stainless steel hood that efficiently exhausts to the outside. Adding to the elegance are the top-tier quartz countertops, providing both durability and sophistication. To enhance the ambiance, pendant lights gracefully hang over the kitchen island, casting a warm glow and adding a touch of modernity to the space.

Breakfast area

The breakfast area is absolutely massive! With its six large windows, it welcomes an abundance of natural light, creating a cozy atmosphere. Whether you prefer a leisurely breakfast or a vibrant brunch, this expansive space offers ample room to savor your meals and indulge in delightful conversations with loved ones.

Covered patio

Check out this huge covered patio! Perfect for enjoying the outdoors, whether it’s raining or basking in abundant sunshine!! It’s an exceptional find, as you rarely find such a spacious outdoor area at such an affordable price. With this expansive patio, you’ll have ample room to host gatherings, set up a cozy relaxation area, or even create your own outdoor oasis for all your favorite activities. Whether lounging in the sun, hosting BBQs, or simply unwinding after a long day, this house offers the perfect space for all your outdoor needs. Take advantage of this rare opportunity to own a home where you can truly embrace the joy of outdoor living!

Primary Bedroom

The spacious main bedroom features elegant recessed ceilings, adding a touch of sophistication and style. With three windows, it is flooded with natural light, creating a bright and inviting atmosphere.

Primary bathroom

The main bathroom is beautifully designed with a luxurious stand-alone bathtub, providing the perfect spot to relax and unwind. It also features separate vanities for him and her, ensuring ample space for personal grooming. The spacious shower boasts a comfortable sitting bench, allowing for a truly indulgent bathing experience. And let’s not forget the large walk-in master closet, offering plenty of storage for all your wardrobe essentials.

Game room

It’s a two-story home, so upstairs, you will find a massive game room that measures 23×11 feet, providing ample space for all your entertainment needs. It’s the perfect place to unwind, have fun with family and friends.

Finishes

This stunning multi-generational home is designed with exquisite attention to detail. Step inside and be captivated by the luxurious vinyl flooring that adds both style and durability. The top-notch fixtures throughout the house showcase the perfect blend of functionality and elegance. As you explore the home, you’ll notice the cool recessed LED lights that create a warm and inviting ambiance. The stylish faucets and fancy door handles add a touch of sophistication to every room. The kitchen is a sanctuary for chefs, boasting luxurious quartz countertops that offer abundant room for crafting culinary masterpieces. The high-quality carpet in the bedrooms offers plush comfort. At the same time, the beautiful tiles in the bathrooms elevate the overall aesthetic. This home truly encompasses the epitome of luxury living.

So, to wrap things up…

This multi-generational home has tons of awesome features that you won’t find in the typical residential homes offered by other builders at this price. It’s thoughtfully designed to cater to the needs of all generations living under one roof. With its open and spacious layout, this house is Ideal for hosting guests, family gatherings, and creating cherished memories with loved ones. The home offers plenty of natural light and a serene ambiance that creates a sense of calmness and tranquility. Plus, it boasts energy-efficient features that contribute to long-term cost savings.

Is it worth considering? I’d say absolutely! But at the end of the day, you’re the one calling the shots. It’s up to you to decide if it’s the perfect home for you!

Photo Gallery of the Multigenerational Home available in the Dallas area (75 photos)

Other Articles In This Category:

Nothing found.

Are you ready to experience the joy of homeownership in the vibrant Dallas-Fort Worth area?

Whether you’re in search of an existing home or a brand-new construction, rest assured that I’m here to assist you every step of the way.

With a dedicated Realtor by your side, the home-buying process becomes a breeze. Say goodbye to stress, and let me handle all the intricate details on your behalf.

Getting the guidance you need is as simple as filling out a brief questionnaire on my Homebuyers contact form. From there, I’ll take care of everything, ensuring a seamless and hassle-free journey towards finding your dream home.

Call/Text 214.940.8149

The Buyer’s Agent Duty

READ: Texas Real Estate Commission Information About Brokerage Services

AS AGENT FOR BUYER/TENANT: The broker becomes the buyer/tenant’s agent by agreeing to represent the buyer, usually through a

written representation agreement. A buyer’s agent must perform the broker’s minimum duties above and must inform the buyer of any

material information about the property or transaction known by the agent, including information disclosed to the agent by the seller or

seller’s agent.

A BROKER’S MINIMUM DUTIES REQUIRED BY LAW (A client is the person or party that the broker represents):

– Put the interests of the client above all others, including the broker’s own interests;

– Inform the client of any material information about the property or transaction received by the broker;

– Answer the client’s questions and present any offer to or counter–offer from the client; and

– Treat all parties to a real estate transaction honestly and fairly.

TO AVOID DISPUTES, ALL AGREEMENTS BETWEEN YOU AND A BROKER SHOULD BE IN WRITING AND CLEARLY ESTABLISH:

– The broker’s duties and responsibilities to you, and your obligations under the representation agreement.

– Who will pay the broker for services provided to you, when payment will be made and how the payment will be calculated.

TYPES OF REAL ESTATE LICENSE HOLDERS:

– A BROKER is responsible for all brokerage activities, including acts performed by sales agents sponsored by the broker.

– A SALES AGENT must be sponsored by a broker and works with clients on behalf of the broker.

Latest from Dallas Real Estate Blog

Score Big Savings on Your New Home in January 2024 - Amazing Home Buyer Incentives Available for Buying a New Construction Home in Dallas-Fort Worth

Did you know that there are some awesome incentives being offered by many Home Builders in the Dallas area for home buyers?

The catch is, these incentives are only available for a limited time and come with certain conditions. However, if you meet the criteria and it aligns with the ideal timing for purchasing a home, it presents a remarkable opportunity to acquire a brand new home with additional advantages that may not be accessible otherwise.

In this blog, I’ll be sharing info on the awesome incentives available in January 2024 for buying a New Construction Home .

Looking for new home builder incentives in the Dallas-Fort Worth area?

Just complete my Home Buyers Contact Form, and I’ll help you find the latest incentives that DFW builders are offering this year. I have all the up-to-date info on builder incentives in the DFW area.

IMPORTANT DISCLAIMER!

Just to clarify, the information shared here is solely for educational purposes! As a Realtor, I don’t have any personal connections to these incentives or how they’re offered. I’m simply sharing the current available incentives that I’ve been made aware of.

Key points to remember about Home Buyer Incentives:

- Incentives are available for a limited time and may expire or change without notice.

- Interest rate financing incentives are only offered when using the builder’s preferred lender.

- Each incentive has conditions, restrictions, and stipulations!

- To receive an incentive, homebuyers must meet the qualification criteria.

Discover Homebuyers Incentives Available in 2024

Looking for incentives that builders offer to homebuyers in 2024? Let me spill a little secret. Builders always have incentives up their sleeves! And guess what? I happen to know a whole bunch of places where builders are offering those incentives. You see, I’m constantly visiting new subdivisions to find great deals for my clients. So, if you want to snag the best incentives out there, just reach out to me. I’ll connect you with the perfect builder that fits your needs.

Financing Incentive

5.875% (6.167% APR) 30 year fixed on a move-in ready home that closes by Feb 29, 2024

5.875% (6.167% APR) 30 year fixed on a build home that closes by Aug 31, 2024

Advertised rates and APR effective as of January 3, 2024 and are subject to change without notice.

NOTE! Restrictions, conditions, and guidelines apply

Financing Incentive

4.99% | 5.783% APR interest rate

Promotional rate available on select homes with sales contracts signed between 01/02/24-01/31/24, or later. Homes must close before 02/29/24. Limited to select homes financed by builder’s preferred lender in participating communities.

NOTE! Restrictions, conditions, and guidelines apply

Financing Incentive

4.99% FIXED interest rate FHA/VA

Offer available on any inventory homes with contracts signed and closed by 01/31/24. Limited Time Offer financed by builder’s preferred lender in participating communities.

NOTE! Restrictions, conditions, and guidelines apply

Limited Time Move-In Incentive

Move-In Incentive includes Top Load Washer/Dryer in white, Stainless steel Side by Side Counter Depth Refrigerator, and Faux Wood Blinds.

Promotional offer is available on select homes when the buyer presents the initial earnest money and contracts by 1/21/24. Buyer may not combine this offer with other offers. Offers, plans, prices, and availability are subject to change without notice.

NOTE! Restrictions, conditions, and guidelines apply

Financing Incentive

$20,000 to lower your interest rate

LIMITED TIME OFFER

Home must be financed with builder’s preferred lender. All eligible sales must be original contracts with the builder signed on or after Jan 1 2024 and on or before Jan 31 2024

Homes must close before 02/29/24. Limited to select homes financed by builder’s preferred lender in participating communities.

NOTE! Restrictions, conditions, and guidelines apply

Financing Incentive

Fixed Rate FHA Mortgage 3.990% (5.867% APR) Interest Rate for year 1 and 4.990% (5.867% APR) Interest Rate for year 2-30. 3.5% down payment required. To receive this offer, borrower is REQUIRED to pay a 0.250% discount point.

Fixed Rate Conventional Mortgage 4.500% (5.885% APR) Interest Rate for year 1 5.500% (5.885% APR) Interest Rate for year 2-30. 10% down payment required. To receive this offer, borrower is REQUIRED to pay a 0.125% discount point

Special Interest Rate with 1/0 Buydown Program features a reduced interest rate for the 1st year and a fixed-rate after the 1st year on certain inventory homes

Discount points may be paid with seller financing incentive offered to the borrower, which will be represented on the Closing Disclosure as a seller’s cost. Maximum contribution limits will apply.

Must contract on or after 01/05/23 in select communities and close on or before 03/29/24.

Financing offered by builder’s preferred lender. All terms and conditions subject to credit approval, market conditions and availability.

Rates only available until pool of funds is depleted or rate expires. Interest rate offered applies only to the builder’s properties purchased as borrower’s principal residence. Not all borrowers will qualify for said rate. Rate is not applicable for all credit profiles. Restrictions apply. Other conditions apply.

NOTE! Restrictions, conditions, and guidelines apply

Do you want to take advantage of these homebuyer incentives?

If you’re in the market for a new home in the Dallas area, then this is definitely something to consider! These incentives can save you money and make the process of buying a home more affordable. Plus, they provide an opportunity to add some upgrades or features that may not have been possible otherwise.

So, don’t miss out on these fantastic offers! Just fill out my Home Buyers Contact Form and I’ll connect you with the Builders.

Nothing found.

Hey Home Buyers! Are you excited to experience the joy of homeownership in the vibrant Dallas-Fort Worth area?

Buying a home in the Dallas-Fort Worth area should feel exciting, not overwhelming. Whether you’re eyeing a charming pre-owned house or a fresh new build, I’m here to make the home buying process simple and straightforward.

I’ll be here to answer your questions, handle the details, and make sure everything falls into place. My goal is to help you buy a home that checks all the boxes for you.

Let’s get started. Fill out my quick Homebuyers contact form and I’ll take it from there.

The Buyer’s Agent Duty

READ: Texas Real Estate Commission Information About Brokerage Services

AS AGENT FOR BUYER/TENANT: The broker becomes the buyer/tenant’s agent by agreeing to represent the buyer, usually through a

written representation agreement. A buyer’s agent must perform the broker’s minimum duties above and must inform the buyer of any

material information about the property or transaction known by the agent, including information disclosed to the agent by the seller or

seller’s agent.

A BROKER’S MINIMUM DUTIES REQUIRED BY LAW (A client is the person or party that the broker represents):

– Put the interests of the client above all others, including the broker’s own interests;

– Inform the client of any material information about the property or transaction received by the broker;

– Answer the client’s questions and present any offer to or counter–offer from the client; and

– Treat all parties to a real estate transaction honestly and fairly.

TO AVOID DISPUTES, ALL AGREEMENTS BETWEEN YOU AND A BROKER SHOULD BE IN WRITING AND CLEARLY ESTABLISH:

– The broker’s duties and responsibilities to you, and your obligations under the representation agreement.

– Who will pay the broker for services provided to you, when payment will be made and how the payment will be calculated.

TYPES OF REAL ESTATE LICENSE HOLDERS:

– A BROKER is responsible for all brokerage activities, including acts performed by sales agents sponsored by the broker.

– A SALES AGENT must be sponsored by a broker and works with clients on behalf of the broker.

Latest from Dallas Real Estate Blog

– Texas Homebuyers Tips, Tricks and Lifehacks

– New Construction Homes in Dallas TX

– Mortgages for Homebuyers and Investors in Dallas-Fort Worth

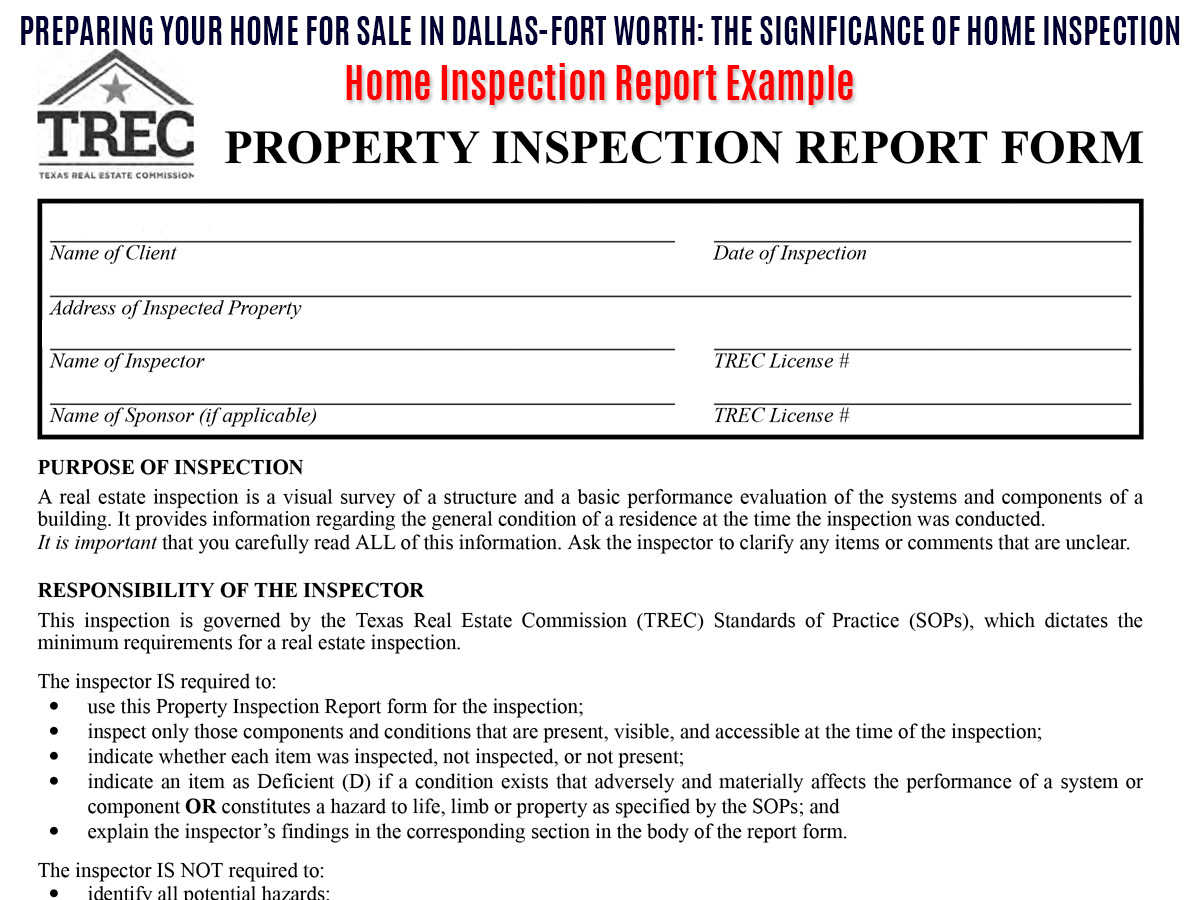

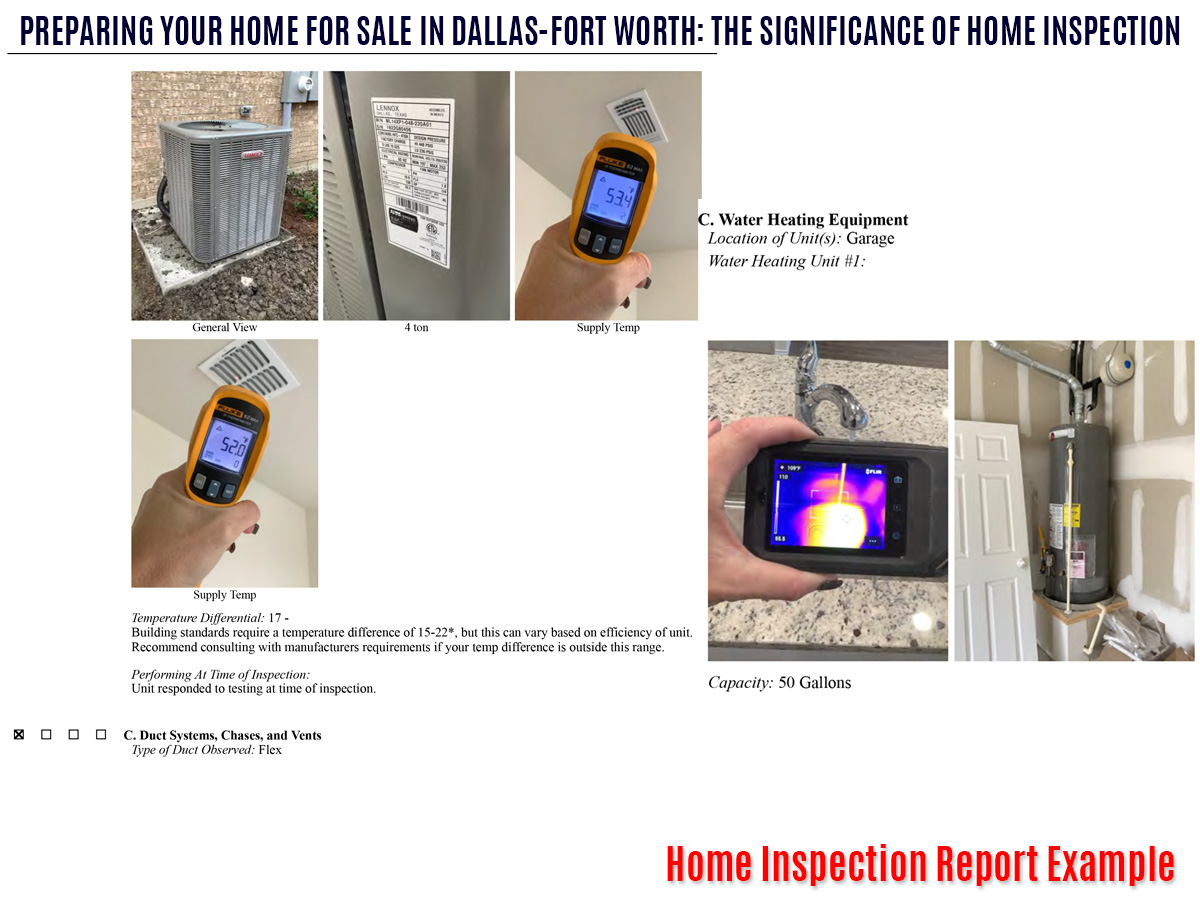

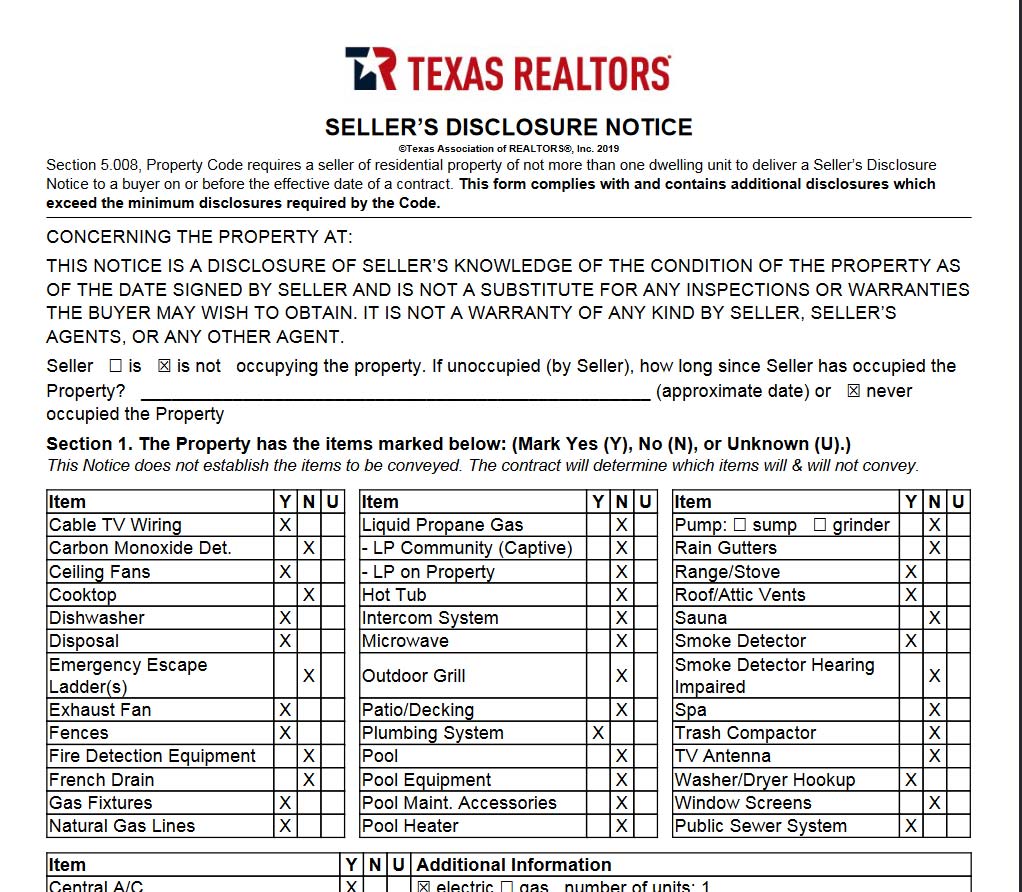

Avoid Stress and Surprises When Selling Your Home in Dallas: The Significance of Home Inspection

Hey there, all you home sellers in the Dallas area! In this blog, I’ve got some tips and tricks to help you out when selling your home.

Today’s topic: Do you really need a home inspection when you’re getting your home ready to sell?

The Significance of Home Inspection in the Home Selling Process

The thing is, every home has its quirks, even brand-new ones. Of course, the extent of these quirks can vary from one home to another.

Another thing is that most residential home sales will typically have a home inspection done during the home selling process. I have an article and a video about the benefits of home inspection that you should check out for a better understanding.

You probably already know that home inspection is usually associated with homebuyers. They use it to uncover any potential issues with the property. The inspection report gives valuable insights into the current condition of the property. However, buyers usually conduct the inspection after their offer is accepted.

So, you might be wondering, why not get the inspection report sooner? That way, the seller wouldn’t have to wait all this time for the buyer’s inspection.

That’s a great question!

As a Realtor, I think it’s a fantastic idea for home sellers to consider getting a home inspection before listing their property.

Scenario #1: Home Inspection after Listing (buyer takes care of it)

Picture this: you’ve spent days, maybe weeks, sprucing up your house for sale. You’ve listed it on the market, advertised it, and even hosted a few Open Houses and showings. But throughout all this, there’s a nagging worry at the back of your mind. What will the buyer’s home inspection uncover? Will you have to spend more on repairs or buyer incentives? This, my friends, can be pretty stressful!

Scenario #2: Pre-Listing Home Inspection (seller does it)

Now, let’s consider a different approach. You hire a home inspector before you list the house on the market. You get all the facts, the good, the bad, and the ugly, about your house. You decide which issues to fix and which ones to leave as-is and adjust the price accordingly. No stress, no surprises, just you setting the tone of the sale. Sounds better, doesn’t it?

Comparing both scenarios

It’s clear that knowledge truly is power. Having an early home inspection gives you the upper hand. You can focus on what really needs fixing during your home prep. And when it comes to negotiations, you’re prepared!

Disclosure of Home Inspection Report by Seller

Now, it’s crucial to remember that you must disclose the inspection report in your Seller disclosure form. Yeah, it’s a bit more paperwork, but trust me, it’s worth it!

Cost of Home Inspection

As for the cost of a home inspection, it varies. You’re looking at anything from $350 to $1000, depending on the size of your property and the type of inspection. Use Google to find some local home inspectors and get a quote.

Wrapping things up

So, is the home inspection worth it for you, a Dallas area home seller? Only you can decide. I hope this post has helped clarify some things for you. And remember, I’m always here to help you on your home-selling journey. A quick phone call or an email, and we can get started!

Remember, you’re not required to do anything. A property can be sold ‘AS IS.’ The value, however, will definitely reflect the property’s condition. So preparation is key if you want the best value from your sale. The effort you put in will show in your property value. Let’s get your house ready for sale together!

Hey Home Sellers! Considering selling your home in the Dallas-Fort Worth area?

Selling a home is like preparing for a big game. You need a solid game plan, the right coach, and a strategy to win. As a Realtor with a Seller Representative Specialist (SRS) designation, I’ll help you tackle every step, from pricing to closing, so you can walk away with a victory.

Fill out my Home Sellers form, and let’s get started.

Call/Text 214.940.8149

Nothing found.

Check out my other articles for more helpful information about the home selling process.

The home-selling process can be daunting, especially for first timers. But don’t worry, I’m here to help. To give you an idea of what to expect, I’ve put together a simple guide with the top things home sellers need to know.

Get more information by checking out my other articles linked below.

– House Selling Process – What You Need To Know

– 6 Factors That Increase Home Value in the Dallas Area

– Determining The Value of Your Home

– Get Your Home Ready To Sell Checklist: A First Impression That Lasts!

– Understanding the Listing Contract

– Staging Your Home To Sell – Will it Help?

– What does a Realtor® do to sell your house?

– How to Have a Successful Showing or Open House (Showings & Open House Checklist)

– Comprehensive Home-Selling Plan To Sell Your House

Latest from Dallas Real Estate Blog

– Texas Home Sellers Tips, Tricks and Lifehacks

– New Construction Homes in Dallas TX

– Mortgages for Homebuyers and Investors in Dallas-Fort Worth

The Seller’s Agent Duty

READ: Texas Real Estate Commission Information About Brokerage Services

AS AGENT FOR OWNER (SELLER/LANDLORD): The broker becomes the property owner’s agent through an agreement with the

owner, usually in a written listing to sell or property management agreement. An owner’s agent must perform the broker’s minimum

duties above and must inform the owner of any material information about the property or transaction known by the agent, including

information disclosed to the agent or subagent by the buyer or buyer’s agent.

A BROKER’S MINIMUM DUTIES REQUIRED BY LAW (A client is the person or party that the broker represents):

– Put the interests of the client above all others, including the broker’s own interests;

– Inform the client of any material information about the property or transaction received by the broker;

– Answer the client’s questions and present any offer to or counter–offer from the client; and

– Treat all parties to a real estate transaction honestly and fairly.

TO AVOID DISPUTES, ALL AGREEMENTS BETWEEN YOU AND A BROKER SHOULD BE IN WRITING AND CLEARLY ESTABLISH:

– The broker’s duties and responsibilities to you, and your obligations under the representation agreement.

– Who will pay the broker for services provided to you, when payment will be made and how the payment will be calculated.

TYPES OF REAL ESTATE LICENSE HOLDERS:

– A BROKER is responsible for all brokerage activities, including acts performed by sales agents sponsored by the broker.

– A SALES AGENT must be sponsored by a broker and works with clients on behalf of the broker.

Preparing your home for sale in Dallas-Fort Worth: 10 Easy Steps That Will Dramatically Improve Your Curb Appeal and Sell Your Home Faster

Hey there, all you home sellers in the Dallas area! If you’re thinking about selling your home, there’s an essential factor you’re going to want to consider: curb appeal. It’s all about making a great first impression, and let’s be honest, we all want our homes to look their best when potential buyers pull up to the curb.

What Exactly is Curb Appeal and Why is it Important?

For those new to the home selling game, Curb appeal is all about how good your property looks from the street. It’s an essential part of selling your home because, believe it or not, it can significantly affect both the speed of the sale and the final selling price.

10 Easy Steps to Boost Your Curb Appeal

Now, let’s talk about the fun part – how to enhance your home’s curb appeal.

Check out these ten simple steps you can easily follow:

Lawn Maintenance:

Start with mowing and applying weed treatment to your lawn. A neat-looking lawn makes your property seem well-maintained and inviting.

Trim Those Trees and Shrubs:

Keep your trees and shrubs well-trimmed. This gives your yard a manicured look, and who doesn’t love that?

Mulch and Flowers:

Sprucing up your flower beds and mulch is a budget-friendly way to bring a burst of color and freshness to your front yard.

Power Wash:

Over time, exteriors can get grimy. A good power wash can work wonders on driveways, porches, and window exteriors.

Exterior Paint and Caulk:

Touch up your exterior paint and caulking. It’s incredible what a difference it can make in making your house look taken care of.

Replace Weather Strips:

Check the weather strips on your doors. Replacing worn-out strips can significantly enhance the overall appearance of your doors.

Front Door:

Consider repainting your front door, or at least giving it a good scrub! A shiny door handle can also do wonders.

Doormat:

Your entry doormat should be new and neutral. If you’re unsure about it, it’s better to ditch it!

Garbage Bins:

don’t forget about your garbage bins. Make sure they’re clean and tucked away.

Exterior Lights:

Make sure all your exterior light bulbs are working. This is especially important for evening viewings.

Why These Steps Matter

Each of these steps, though simple, can dramatically enhance your property’s curb appeal. They make your home look well cared for and inviting – exactly what potential buyers want to see!

Don’t Forget About the Backyard

These steps aren’t just for the front of your house. Apply them to your backyard as well, and you’ll love the result.

Wrapping Up

Enhancing your home’s curb appeal can significantly impact your home-selling experience.

There’s no end to what you can do to boost your curb appeal. It all comes down to the effort and budget you’re willing to invest. However, these 10 simple steps for enhancing your home’s curb appeal are a must when getting your Dallas area home ready for sale.

And remember, I’m here to help! If you’re considering selling your Dallas home, don’t hesitate to reach out. Contact me today and let’s get your property sold together!

Explore the recently sold homes in the Dallas-Fort Worth area, where savvy home sellers have successfully enhanced the curb appeal of their properties using these 10 simple yet effective steps.

Hey Home Sellers! Considering selling your home in the Dallas-Fort Worth area?

Selling a home is like preparing for a big game. You need a solid game plan, the right coach, and a strategy to win. As a Realtor with a Seller Representative Specialist (SRS) designation, I’ll help you tackle every step, from pricing to closing, so you can walk away with a victory.

Fill out my Home Sellers form, and let’s get started.

Call/Text 214.940.8149

Nothing found.

Check out my other articles for more helpful information about the home selling process.

The home-selling process can be daunting, especially for first timers. But don’t worry, I’m here to help. To give you an idea of what to expect, I’ve put together a simple guide with the top things home sellers need to know.

Get more information by checking out my other articles linked below.

– House Selling Process – What You Need To Know

– 6 Factors That Increase Home Value in the Dallas Area

– Determining The Value of Your Home

– Get Your Home Ready To Sell Checklist: A First Impression That Lasts!

– Understanding the Listing Contract

– Staging Your Home To Sell – Will it Help?

– What does a Realtor® do to sell your house?

– How to Have a Successful Showing or Open House (Showings & Open House Checklist)

– Comprehensive Home-Selling Plan To Sell Your House

Latest from Dallas Real Estate Blog

– Texas Home Sellers Tips, Tricks and Lifehacks

– New Construction Homes in Dallas TX

– Mortgages for Homebuyers and Investors in Dallas-Fort Worth

The Seller’s Agent Duty

READ: Texas Real Estate Commission Information About Brokerage Services

AS AGENT FOR OWNER (SELLER/LANDLORD): The broker becomes the property owner’s agent through an agreement with the

owner, usually in a written listing to sell or property management agreement. An owner’s agent must perform the broker’s minimum

duties above and must inform the owner of any material information about the property or transaction known by the agent, including

information disclosed to the agent or subagent by the buyer or buyer’s agent.

A BROKER’S MINIMUM DUTIES REQUIRED BY LAW (A client is the person or party that the broker represents):

– Put the interests of the client above all others, including the broker’s own interests;

– Inform the client of any material information about the property or transaction received by the broker;

– Answer the client’s questions and present any offer to or counter–offer from the client; and

– Treat all parties to a real estate transaction honestly and fairly.

TO AVOID DISPUTES, ALL AGREEMENTS BETWEEN YOU AND A BROKER SHOULD BE IN WRITING AND CLEARLY ESTABLISH:

– The broker’s duties and responsibilities to you, and your obligations under the representation agreement.

– Who will pay the broker for services provided to you, when payment will be made and how the payment will be calculated.

TYPES OF REAL ESTATE LICENSE HOLDERS:

– A BROKER is responsible for all brokerage activities, including acts performed by sales agents sponsored by the broker.

– A SALES AGENT must be sponsored by a broker and works with clients on behalf of the broker.

The Power of a Fresh Paint Coat: Why Painting Your House Before Listing It For Sale in Dallas Is a Game-Changer! See before and after photos

Attention future home sellers in the Dallas-Fort Worth area! Are you considering putting your house on the market? Is this your first time selling a property, or have you tried before without success? If you responded affirmatively to any of these questions, this article could be of great assistance to you.

Topic of the day: Should you paint the interior of your house before listing it for sale? I will provide valuable insights based on my firsthand experience of successfully selling multiple homes in the Dallas area.

Let’s get started!

Home selling is like a battle of wills. Here’s what sellers should expect!

If you’re new to selling a home, make sure to check out my Home Sellers section. It’s a great place to get familiar with the basics of selling your home.

When it comes to selling a house, there’s usually some compromise involved. Sellers want to get the most money for their property, while buyers want to spend as little as possible. In a perfect world, everyone would be selling a flawless property with no issues. Wouldn’t that be nice?

But let’s face it, we don’t live in a perfect world. The truth is, every house has its quirks, even new-construction homes. Eventually, sellers will find themselves confronted with the choice of addressing these issues, providing substantial discounts, or running the risk of the sale falling through.

The most crucial thing every home seller should do before putting the house up for sale.

It’s all about the presentation, the goal is to showcase the house in its best light so that potential buyers fall head over heels for it.

This involves getting your property ready for sale, which means de-cluttering, cleaning, and fixing any obvious issues to make it shine.

If you do that, When a prospective homebuyer visits, your home will stand out from the rest.

It’s basic psychology: if you have two choices of the same property – one dirty and cluttered and one clean and de-cluttered – buyers will undoubtedly choose the clean one or offer a significantly lower price for the messy one.

Let’s talk about paint.

One of the most crucial steps in preparing your home for sale is considering the state of your interior paint.

An immaculate paint job can make your home seem well-maintained and ready to move in, which is exactly what many buyers are looking for.

A new layer of paint has the remarkable ability to transform your house, making it more appealing to prospective buyers and breathing new life into your home.

You might run into some problems if you have different wall colors.

Yes, you heard that right: the color of your walls can indeed influence the marketability of your property.

Here is why. You might adore the ocean blue in your bedroom or the sunshine yellow in your living room, but what if your potential buyers don’t? Diverse wall colors can present a stumbling block in the home sale process because, let’s face it, everyone’s taste is unique.

Having too many colors in your house can be overwhelming and might even detract from the overall allure of your home.

Let’s not forget that after years of living in a house, those painted walls can start showing some significant wear and tear. That might not be so appealing to potential buyers.

A real-life example of how interior paint affected the home sale.

Let me share with you a real-life example from my real estate career, where the choice of interior paint had a significant impact on a home sale.

A home I was selling in Princeton, TX had four different wall colors throughout the house – quite the color palette, indeed!

Despite my recommendations, sellers initially resisted making changes. It wasn’t until the feedback from potential buyers – who either withdrew their offers or quoted much lower prices – that the sellers decided to repaint the entire house in a uniform color.

The result? Offers flooded in, and the house was sold at the desired price shortly after.

Please take a moment to view the before and after photos of the house I recently sold described in the above example.

Before painting

After painting

Before painting

After painting

Before painting

After painting

Before painting

After painting

So, to paint or not to paint? That is the question!

Now you might be wondering, “Should I repaint my house?” The answer depends on your current paint job.

If your house has multiple colors or the paint is significantly worn out, a fresh coat might be necessary to attract the best offers.

Like everything else, there are pros and cons. Let’s check them out!

The PROS

The benefits are plentiful. Fresh paint sells the idea that the house is ready to move in.

Usually, painters fix minor wall damages in the process.

The house painted in a trendy and consistent color will totally impress potential buyers!

The CONS

But it’s not all roses. Painting a house can be a hassle.

It costs money, requires time, and involves decision-making, like finding and scheduling contractors, figuring out which color to use, and all that jazz.

Before painting

After painting

Before painting

After painting

Remember, the choice is ultimately yours and depends on how much effort you want to put in for the best results.

Let’s talk about picking the color for the new paint. Here’s a lifehack for you!

If you’ve decided to repaint, the next question is: what color should you choose?

A simple lifehack from a seasoned realtor (yours truly): visit new construction communities and look at several model homes.

These homes are usually designed with the current market preferences in mind, so they can provide you with some valuable insights into what potential buyers might be interested in.

Before painting

After painting

Before painting

After painting

Before painting

After painting

Conclusion

To wrap up, if you aim to get the highest price for your property, some preparation is inevitable. If not, you can choose to sell your property as-is. I hope this information helps you on your home-selling journey.

And remember, if you’re planning to sell your home in the DFW area, I’m here to help! I can assist you with everything you need, including choosing the perfect paint color.

So, what do you say? Are you ready to paint the town (or at least your house) and sell your home? I can’t wait to help you make it happen. Happy home selling!

Hey Home Sellers! Considering selling your home in the Dallas-Fort Worth area?

Selling a home is like preparing for a big game. You need a solid game plan, the right coach, and a strategy to win. As a Realtor with a Seller Representative Specialist (SRS) designation, I’ll help you tackle every step, from pricing to closing, so you can walk away with a victory.

Fill out my Home Sellers form, and let’s get started.

Call/Text 214.940.8149

Nothing found.

Check out my other articles for more helpful information about the home selling process.

The home-selling process can be daunting, especially for first timers. But don’t worry, I’m here to help. To give you an idea of what to expect, I’ve put together a simple guide with the top things home sellers need to know.

Get more information by checking out my other articles linked below.

– House Selling Process – What You Need To Know

– 6 Factors That Increase Home Value in the Dallas Area

– Determining The Value of Your Home

– Get Your Home Ready To Sell Checklist: A First Impression That Lasts!

– Understanding the Listing Contract

– Staging Your Home To Sell – Will it Help?

– What does a Realtor® do to sell your house?

– How to Have a Successful Showing or Open House (Showings & Open House Checklist)

– Comprehensive Home-Selling Plan To Sell Your House

Latest from Dallas Real Estate Blog

– Texas Home Sellers Tips, Tricks and Lifehacks

– New Construction Homes in Dallas TX

– Mortgages for Homebuyers and Investors in Dallas-Fort Worth

The Seller’s Agent Duty

READ: Texas Real Estate Commission Information About Brokerage Services

AS AGENT FOR OWNER (SELLER/LANDLORD): The broker becomes the property owner’s agent through an agreement with the

owner, usually in a written listing to sell or property management agreement. An owner’s agent must perform the broker’s minimum

duties above and must inform the owner of any material information about the property or transaction known by the agent, including

information disclosed to the agent or subagent by the buyer or buyer’s agent.

A BROKER’S MINIMUM DUTIES REQUIRED BY LAW (A client is the person or party that the broker represents):

– Put the interests of the client above all others, including the broker’s own interests;

– Inform the client of any material information about the property or transaction received by the broker;

– Answer the client’s questions and present any offer to or counter–offer from the client; and

– Treat all parties to a real estate transaction honestly and fairly.

TO AVOID DISPUTES, ALL AGREEMENTS BETWEEN YOU AND A BROKER SHOULD BE IN WRITING AND CLEARLY ESTABLISH:

– The broker’s duties and responsibilities to you, and your obligations under the representation agreement.

– Who will pay the broker for services provided to you, when payment will be made and how the payment will be calculated.

TYPES OF REAL ESTATE LICENSE HOLDERS:

– A BROKER is responsible for all brokerage activities, including acts performed by sales agents sponsored by the broker.

– A SALES AGENT must be sponsored by a broker and works with clients on behalf of the broker.

Six master-planned communities in Dallas-Fort Worth have been recognized among the nation's TOP 50! Discover which ones have made the prestigious list.

The highly anticipated annual TOP 50 List of master-planned communities in the US has just been unveiled!

Guess what? Out of the 50, we’ve got 6 awesome communities in Collin and Denton Counties that made the cut!

It’s a testament to the remarkable quality and appeal of these communities, showcasing their undeniable allure and desirability.

Here’s why it’s important:

As Texas continues to grow, so does the demand for housing. And based on the sales record, homebuyers really see the value of master-planned communities. These communities are not just everywhere; they’re something special that takes living standards to a whole new level. And guess what? We have these fantastic developments right here in the DFW area. If you’re interested in buying a home in one of the top 50 master-planned communities in the whole nation, reach out to me, and I’ll make it happen. Having a realtor by your side makes home-buying much easier and less stressful. Let’s find your dream home together!

Here are the communities that made it to the national TOP 50 list:

#16 Silverado, in Aubrey, Texas, with 721 home sales

#33 Windsong Ranch in Prosper, Texas with 551 home sales

#41 Painted Tree in McKinney, Texas with 448 home sales

#45 Pecan Square in Northlake, Texas with 405 home sales

#46 Union Park in Little Elm, Texas with 402 home sales

#48 Harvest in Argyle, Texas with 391 home sales

Unlock Exceptional Service: Get in Touch with Me Today

Assistance with all your real estate needs in the Dallas-Fort Worth area is just a click or call away. Reach out at 214-940-8149 or connect through the links below.

So, what exactly is a master-planned community?

Master-planned communities (MPCs) are a special kind of residential development. They’re based on a comprehensive plan by a master developer, which includes various housing types, sizes, and prices. MPCs also have shared common spaces, amenities, and a vibrant public realm.

The best MPCs, the ones that become top sellers, are usually developed with a strong vision and a comprehensive plan. This plan guides development and brings the community together through unique signage, wayfinding, entry features, landscaping, and architectural design standards.

MPCs set themselves apart from typical suburban subdivisions by creating a true sense of community. They provide a space where neighbors can interact and foster an environment for generations to thrive in housing and community. Many even offer educational opportunities, local shops, services, and job centers to complement the residential areas. The most resilient MPCs have flexible master plans that are environmentally conscious, responsive to the market, and enhance the residents’ lifestyles.

Here’s how the rankings are calculated:

The ranking of the Top-Selling Master-Planned Communities in 2023 is based on the total number of new home sales, after deducting cancellations, as reported by each community. Communities shared preliminary sales numbers in early December, which were then annualized to estimate year-end sales. Final sales figures were provided in the first week of January, with some updates throughout the month. To be included in this ranking, MPCs must have certain features.

Who’s in charge of the ranking?

Introducing RCLCO Real Estate Consulting! Every year since 1994, they’ve conducted a national survey to identify the top-selling master-planned communities (MPCs) across the country. It’s their 30th consecutive year, and this initiative not only recognizes the most successful communities but also monitors the overall health of the for-sale housing industry. They’re all about highlighting trends and learning from the best practices of pioneering MPCs. The 30th Edition for 2023 showcases the rankings of The Top-Selling Master-Planned Communities of 2023, based on their survey of MPCs nationwide.

Which state boasts the most winning communities?

Florida accounted for about 40% of sales in the top-ranked communities, with Texas coming in at nearly 37%.

Here are the key takeaways to keep in mind:

In general, the sales of MPC in 2023 surpassed expectations. A lot of developers who took part in this survey mentioned that the incentives provided by builders played a crucial role in the successful pace of home sales in 2023.

Sales in the Top-50 communities saw a solid increase of nearly 14% in 2023 compared to the slower sales pace set by the Top-50 MPCs of 2022. Many developers mentioned having better access to materials and more favorable inventory levels for new construction. However, sales in the second half of the year were slower than in the first half. This was due to factors such as lower overall job growth, mortgage rates peaking at 7.8% in October, and slower economic growth in the fourth quarter.

Despite a potential slowdown in Q1 2024, RCLCO expects new home sales to gradually increase throughout the year. As mortgage rates slowly decline and home price growth moderates, the outlook is optimistic. The Mortgage Bankers Association predicts rates of 6.1% by the end of 2024, while Fannie Mae expects a dip to 6.5% over the same period. With declining rates and an improving economy in the second half, new home sales are expected to catch up with Q3 2023.

Visit RCLCO website: https://www.rclco.com/

Ready to experience the unparalleled standard of living in the vibrant DFW?

Get in touch with me today, and let me help you find the perfect home in a master-planned community.

Photos of Master-Planned Communities in Dallas-Fort Worth

Nothing found.

Hey Home Buyers! Are you excited to experience the joy of homeownership in the vibrant Dallas-Fort Worth area?

Buying a home in the Dallas-Fort Worth area should feel exciting, not overwhelming. Whether you’re eyeing a charming pre-owned house or a fresh new build, I’m here to make the home buying process simple and straightforward.

I’ll be here to answer your questions, handle the details, and make sure everything falls into place. My goal is to help you buy a home that checks all the boxes for you.

Let’s get started. Fill out my quick Homebuyers contact form and I’ll take it from there.

The Buyer’s Agent Duty

READ: Texas Real Estate Commission Information About Brokerage Services

AS AGENT FOR BUYER/TENANT: The broker becomes the buyer/tenant’s agent by agreeing to represent the buyer, usually through a

written representation agreement. A buyer’s agent must perform the broker’s minimum duties above and must inform the buyer of any

material information about the property or transaction known by the agent, including information disclosed to the agent by the seller or

seller’s agent.

A BROKER’S MINIMUM DUTIES REQUIRED BY LAW (A client is the person or party that the broker represents):

– Put the interests of the client above all others, including the broker’s own interests;

– Inform the client of any material information about the property or transaction received by the broker;

– Answer the client’s questions and present any offer to or counter–offer from the client; and

– Treat all parties to a real estate transaction honestly and fairly.

TO AVOID DISPUTES, ALL AGREEMENTS BETWEEN YOU AND A BROKER SHOULD BE IN WRITING AND CLEARLY ESTABLISH:

– The broker’s duties and responsibilities to you, and your obligations under the representation agreement.

– Who will pay the broker for services provided to you, when payment will be made and how the payment will be calculated.

TYPES OF REAL ESTATE LICENSE HOLDERS:

– A BROKER is responsible for all brokerage activities, including acts performed by sales agents sponsored by the broker.

– A SALES AGENT must be sponsored by a broker and works with clients on behalf of the broker.

Latest from Dallas Real Estate Blog

– Texas Homebuyers Tips, Tricks and Lifehacks

– New Construction Homes in Dallas TX

– Mortgages for Homebuyers and Investors in Dallas-Fort Worth

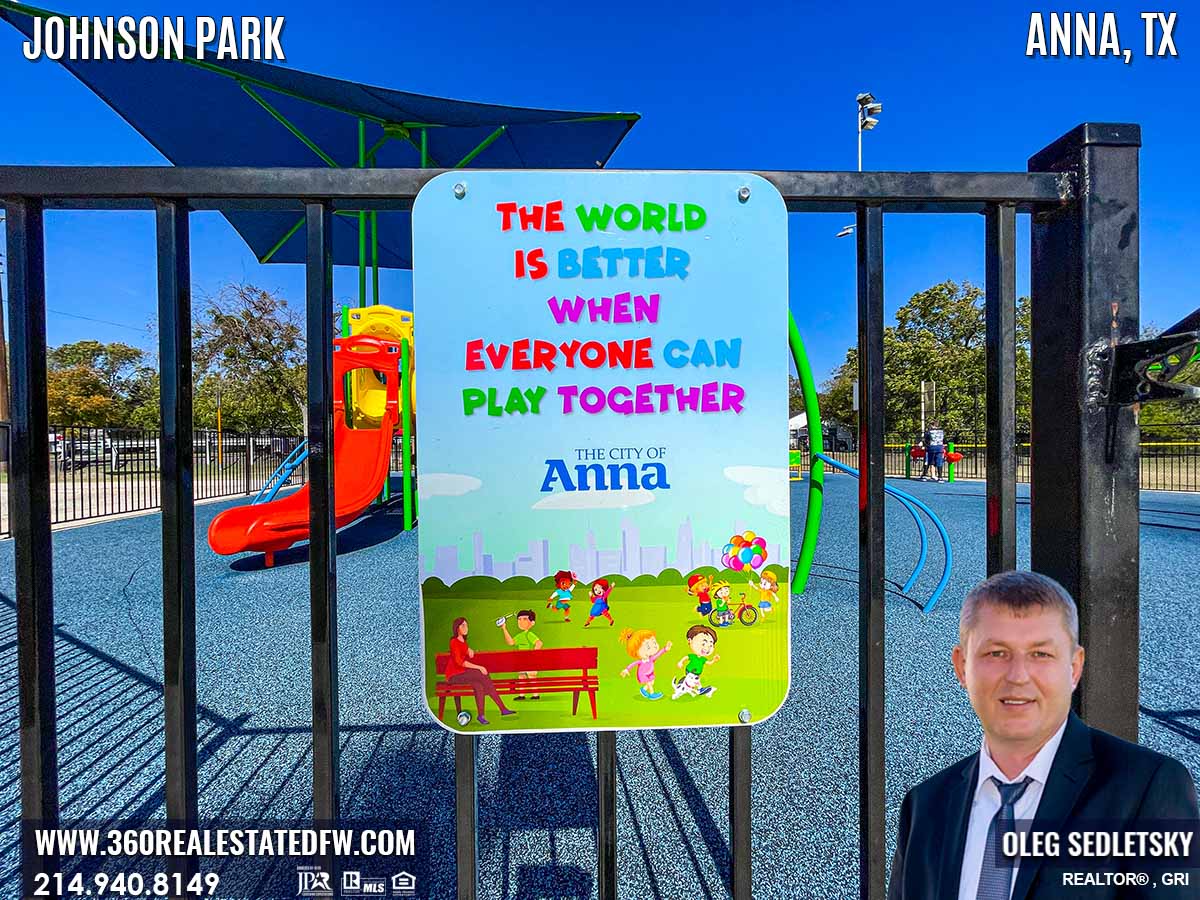

Things to do in Anna, TX - Explore Johnson Park, home to a Remarkable All-Inclusive Playground in Anna, TX

Hey there, welcome to my blog, “Living in Dallas-Fort Worth“! In this article, come along with me as we head to Anna, TX, and check out this super charming local park.

Whether you’re a newcomer to Anna, TX, or contemplating a relocation to this thriving community, there are countless reasons to fall in love with life here.

Today, I am delighted to showcase a beloved local gem: Johnson Park.

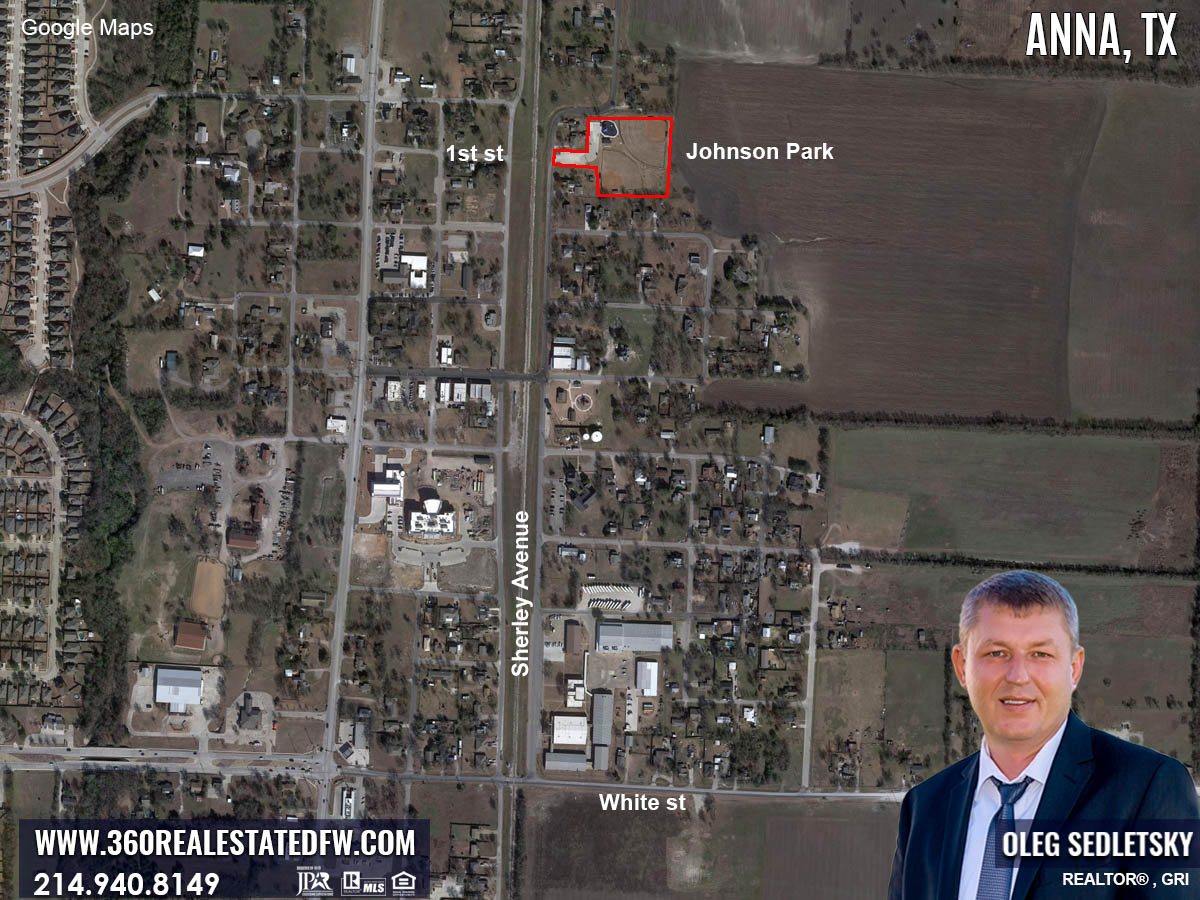

Location of Johnson Park