Hello, future homeowners!

In this article, I’m going to show you how being preapproved for a mortgage can do miracles in your homebuying process. As I mentioned in my article about Mortgage Loan Applications, when you start your home-buying journey, it is important to know where you stand in terms of financing so you can properly identify the price point of homes that you can afford to buy.

What is Mortgage Preapproval, and When is it Issued?

Mortgage pre-approval is basically the document that shows how much you can afford to spend and confirms that you qualify for a loan. It’s especially important for home sellers to know.

To issue a pre-approval, a Mortgage Loan Originator will take the following steps:

- Verify your information, including assets, real estate, credit history, employment, and other relevant details.

- Collect all necessary documents from you.

- Submit your loan application for the underwriting process.

Once the underwriter reviews your file, a conditional pre-approval will be issued.

You might wonder why it’s conditional. Well, there are still some things that could disqualify you for a loan on a specific property. These include the home price, the condition of the property, and the appraisal. Because if the appraisal comes in lower than the asking price, that can create issues with final loan approval.

Plus, any recent changes in your financial situation, like losing income, taking on more debt, or changes in alimony or child support, can impact your approval.

So, it’s super important to keep in mind the Do’s and Don’ts while you’re in the process of buying a house.

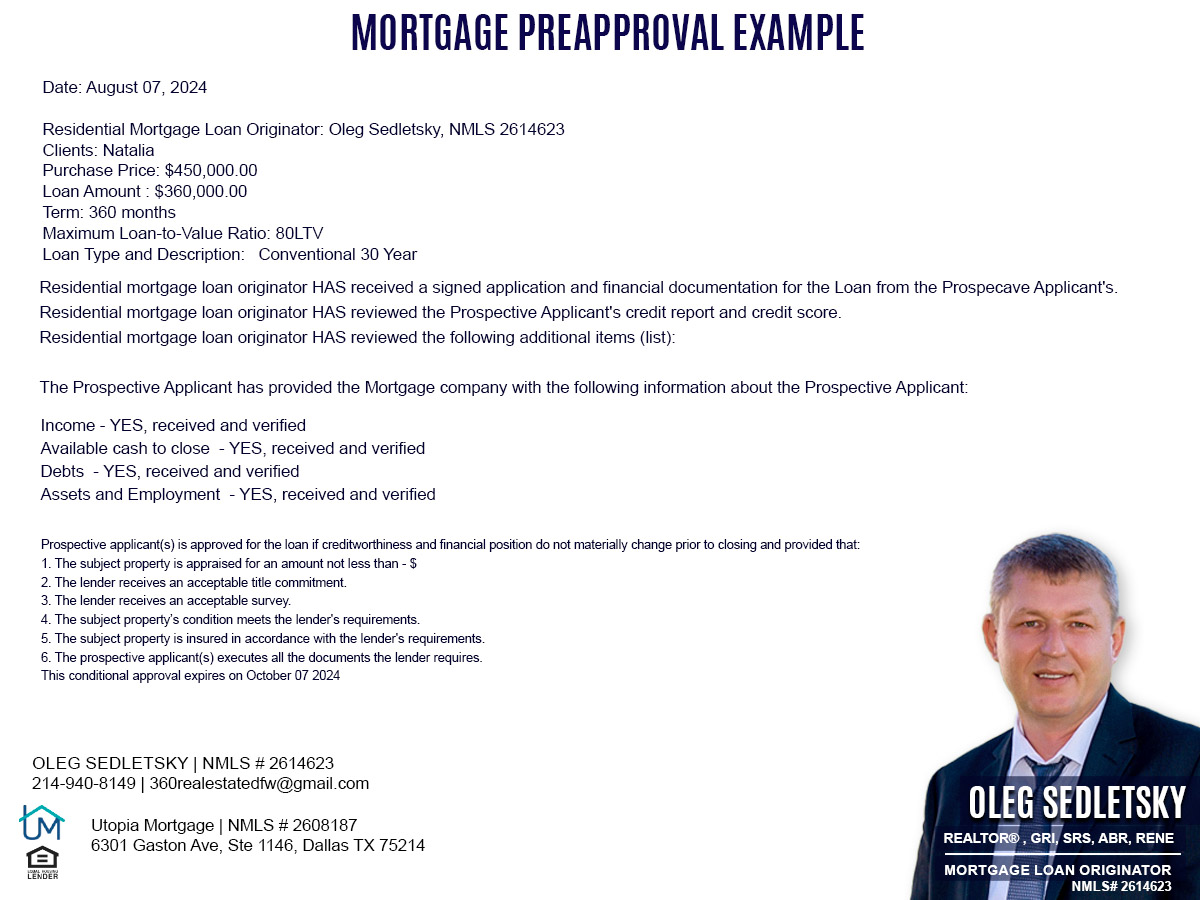

Here’s an example of an official mortgage preapproval that’s been issued to a potential homebuyer.

How can you get the mortgage preapproval?

It all starts with the Mortgage Loan Application! Just make sure to submit all the necessary documents along with it. Once your Mortgage Loan Originator gets your application and those documents, they’ll take the steps described above to get you a conditional pre-approval.

Please note: If you can’t provide the required documents, you won’t be able to get the mortgage pre-approval because your Mortgage Loan Originator won’t be able to verify your info.

When Is the Right Time to Obtain Mortgage Preapproval?

You might be wondering when the best time is to get mortgage preapproval. Should you do it early in the home-buying process, or wait until you find a specific property?

I recommend getting preapproved before you start your home search. Knowing your budget from the get-go will save you a lot of time!

Why is getting mortgage preapproval so important?

The first thing to know is that getting preapproved for a mortgage is more beneficial for you as a homebuyer than for the seller. That said, it really strengthens your offer when you’re buying a home, especially when home sellers have to make tough choices.

With pre-approval, you’ll know the mortgage amount for which you qualify, allowing you to establish your budget. This knowledge helps you focus on homes that fit your financial parameters and criteria, eliminating wasted time.

When sellers see your verifiable preapproval, they are more likely to take your offer seriously and prioritize it over other offers without preapproval. In Texas, having preapproval is essential; sellers are unlikely to waste time waiting for your mortgage approval.

Overall, obtaining preapproval can save you a considerable amount of time by ensuring you only consider properties you can afford.

Does Mortgage Pre-approval Expire in Texas?

Mortgage preapproval typically has an expiration date ranging from 30 to 90 days. Once this date is reached, you may need to resubmit certain documents, and your credit report might be re-evaluated.

Can you actually buy a home without getting mortgage pre-approval?

If you’re paying cash, the answer is definitely yes! But if you’re planning to finance your home purchase, it’s pretty unlikely that your offer will get accepted without a mortgage preapproval.

As a Realtor, I can assure you that 99.9% of sellers in Texas will not consider your offer without mortgage preapproval. Sellers usually want to play it safe, so they’re more likely to accept offers from buyers with verifiable mortgage preapproval. It shows the buyer can actually purchase the property!

Is Mortgage Preapproval Necessary When Buying a Home in Texas?

As a Realtor with extensive experience and multiple designations, as well as a Mortgage Loan Originator in Texas, I can confidently say that mortgage preapproval is essential! It’s a crucial part of the home-buying process, especially if you’re thinking about using financing. Contact me today to assist you with your mortgage loan application and help you secure preapproval for purchasing a residential property in TEXAS.

Apply For A Mortgage Today!

Applying for a mortgage is simple and convenient. I offer both an online application option and the ability to apply over the phone.

APPLY FOR YOUR HOME LOAN HERE – Enjoy a secure and easy online mortgage application process.

Call 214-940-8149 now to apply by phone.

Just fill out the Mortgage Application, and you’ll be one step closer to unlocking your dream home. Once I receive your information, I’ll assess your current situation and determine the home price you’re qualified for. Together, we’ll explore tailored recommendations on mortgage products and identify any improvement areas to pave your path to success!