The 2022 real estate market in Princeton, Texas experienced a pivotal shift, shaped by economic adjustments such as the rise in 30-year average mortgage rates to 5.53%. Despite the increased cost of financing, property values soared to record-breaking levels, with both average and median prices reaching all-time highs. New construction homes and properties featuring pools remained in high demand, reflecting continued growth and evolving lifestyle preferences in the area.

Key Takeaways and Trends from Princeton’s 2022 Real Estate Market

Pricing Range: Princeton, TX saw its pricing range expand, with the minimum price rising slightly and the maximum reaching $1.6M.

Market Efficiency: Properties sold much faster in 2022 (21 days compared to 38 days in 2021), and close-to-list price ratios held steady at over 101%.

Unique Outliers: The most expensive property sold not only broke pricing records but also reflected growing interest in luxury acreage and leisure-friendly features.

Mortgage Rates Impact: Despite mortgage rates jumping from 3.15% to 5.53%, demand remained strong, driven by lifestyle-focused decisions and buyer competition.

Total Homes Closed

A total of 690 single-family homes were sold in 2022, marking an overall decline from 849 the previous year.

New construction homes accounted for 249 properties, showing sustained demand for modern builds.

Homes with pools increased to 17 properties, indicating a growing appeal for leisure-oriented features.

Property Pricing Insights

- Minimum Price: $135,000

- Maximum Price: $1,600,000

- Average Price: $369,296 (up from $311,550 in 2021)

- Median Price: $351,996 (up from $300,000 in 2021)

Rising prices reflect stronger competition and evolving homebuyer priorities.

Property Size and Features

- Bedrooms: Ranged from 1 to 6, with an average of 4 bedrooms per home.

- Bathrooms: Ranged from 1 to 5, with most homes featuring 2 bathrooms on average.

- Square Footage: Homes ranged from 576 sqft to 5,348 sqft, with an average of 1,869 sqft—a slight decrease from 2021.

- Lot Size: Varied from 0 to 19,189 acres, with the median being 0.140 acres, showing smaller average lot sizes in general.

Market Dynamics

- Days on Market (DOM): Homes sold in an average of 21 days, a sharp improvement from 38 days in 2021, highlighting faster sales.

- ClsPr/LstPr Ratio: Averaged 101.63%, showing sustained demand with buyers paying slightly above listing prices.

- ClsPr/OLP Ratio: Spiked to 245.02%, driven by standout properties that performed exceptionally well.

- Average Price Per SqFt: $201.61, up significantly from $154.56 in 2021.

Insights into the Most Expensive Princeton, TX Property Sold in 2022

The most expensive property sold in Princeton in 2022 was a stunning 4-bedroom, 3-bathroom estate built in 1986, exuding both charm and modern luxury. Spanning an impressive 5,348 square feet, the home featured a spacious layout perfect for upscale living. It sat on a vast 12.061-acre lot, providing plenty of both privacy and outdoor possibilities. This luxurious property also boasted a beautiful pool, making it an ideal retreat for relaxation and leisure. Selling for $1,600,000, the home commanded a price of $299.18 per square foot, showcasing its premium value. What’s more, it moved quickly, with a record-breaking 6 days on market (DOM). The sale price exceeded the listing price, achieving a ClsPr/LstPr (close price to listing price) ratio of 108.48% and demonstrating its high buyer demand. The same ratio for ClsPr/OLP (close price to original listing price) was also 108.48%, indicating consistent interest and competitiveness of the listing.

Key Highlights::

- Price: $1,600,000

- Beds/Baths: 4 bedrooms, 3 bathrooms

- Square Footage: 5,348 sqft

- Price/SqFt: $299.18

- Lot Size: 12.061 acres

- DOM: 6 days

- ClsPr/LstPr Ratio: 108.48%

- ClsPr/OLP Ratio: 108.48%

- Year Built: 1986

Economic context

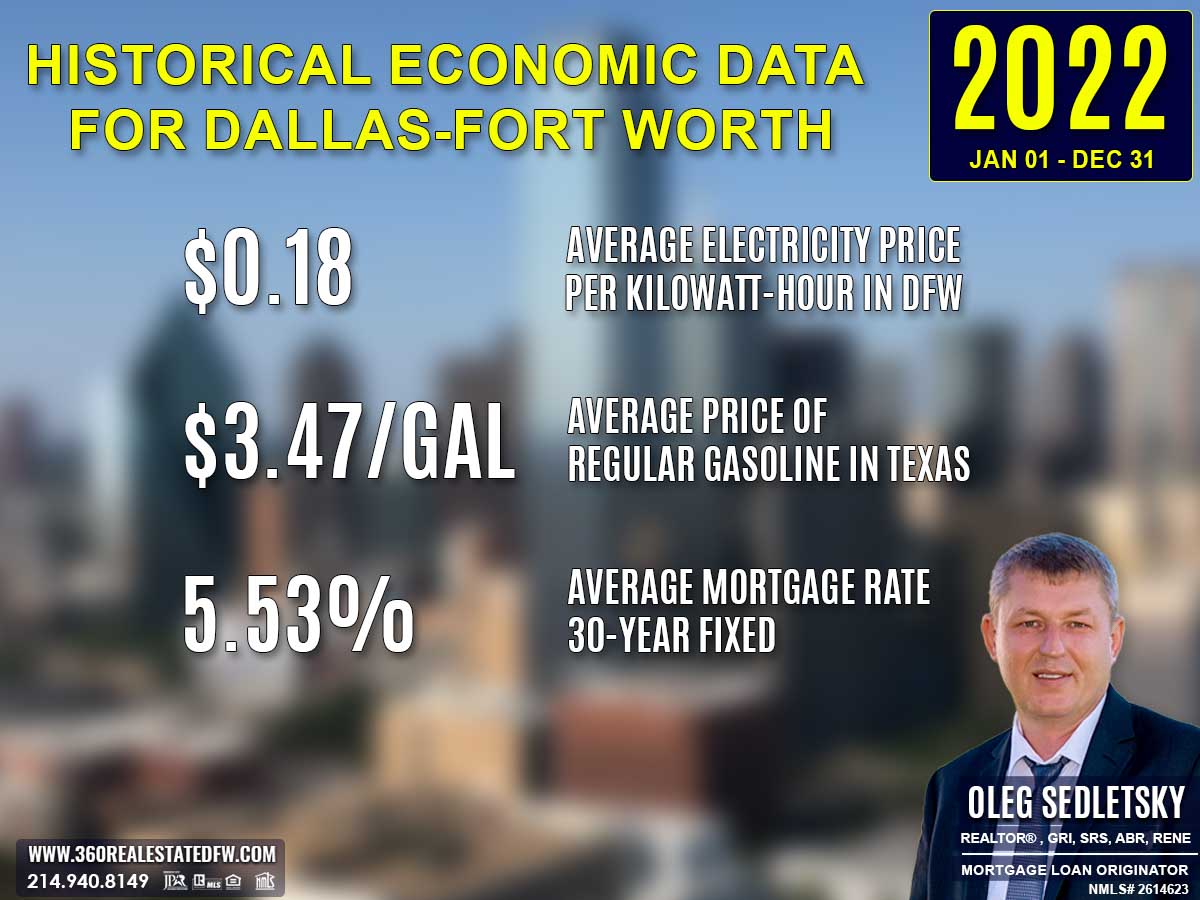

Average Electricity Costs in Dallas-Fort Worth in 2022

Average electricity prices spiked to $0.18 per kilowatt-hour in 2022, a sharp increase from $0.14 in 2021. Higher energy expenses placed added strain on household budgets, driving demand for energy savings. Homes with modern insulation, solar installations, or energy-saving appliances gained significant appeal during this period.

Average Price for Regular Gasoline in Texas in 2022

Gas prices surged to $3.47 per gallon in 2022, jumping from $2.65 in 2021. The substantial increase in transportation costs likely swayed homebuyers to favor central locations or areas close to public transit. Long commutes to suburban or rural homes might have lost some appeal in light of elevated gas prices.

Average 30-Year Fixed Mortgage Rate in 2022

Mortgage rates climbed steeply to 5.53% in 2022, up from 3.15% the year before. The notable rise in rates significantly impacted affordability, persuading many to reassess their homeownership goals. Homebuyers were urged to secure pre-approval with a local mortgage loan originator to better understand their financial limits in a tightened market.

Curious about today’s mortgage rates and the home you can comfortably afford?

Submit a no-obligation mortgage application today and get pre-approved to determine your budget and take the first step toward homeownership with confidence.

Overview of Differences Between the 2021 and 2022 Real Estate Markets in Princeton, Texas

Volume of Sales

Sales volume dropped from 849 homes in 2021 to 690 homes in 2022, marking an 18.7% decline, likely influenced by rising mortgage rates and affordability constraints.

Pricing

- The minimum price rose from $115,000 to $135,000, while the maximum price increased slightly to $1.6M.

- Average prices climbed from $311,550 in 2021 to $369,296 in 2022, reflecting an 18.5% rise.

- Median prices also rose, from $300,000 in 2021 to $351,996 in 2022, indicating broader price appreciation across the market.

Market Efficiency

- Days on Market (DOM): Improved significantly, dropping from 38 days in 2021 to just 21 days in 2022.

- ClsPr/LstPr ratios: Held steady at just over 101%, indicating properties continued to sell above listing price.

- ClsPr/OLP ratios: Increased dramatically from 245.02% to much higher levels, driven by standout transactions and market dynamics.

Property Features

- Square Footage: Average home size slightly decreased from 1,902 sqft in 2021 to 1,869 sqft in 2022.

- Lot Sizes: Median lot sizes remained small, with a marginal difference between both years.

- Pools: Homes with pools sold increased from 11 in 2021 to 17 in 2022, showing rising demand for leisure features.

- New Construction Homes: Sales declined from 402 in 2021 to 249 in 2022, signaling a slowdown in new developments.

Economic Context

Average mortgage rates rose from 3.15% in 2021 to 5.53% in 2022, which likely constrained affordability and contributed to reduced sales volume.

Rising costs for utilities and fuel also impacted overall purchasing power for buyers.

These differences highlight the market’s resilience and adaptability despite economic challenges, with rising prices and faster sales underscoring strong demand for quality properties.

Summary of Real Estate Market Analysis for Princeton, TX in 2022

The 2022 real estate market in Princeton, Texas presented unique challenges and opportunities for both homebuyers and home-sellers, shaped by shifting economic conditions and evolving buyer preferences.

Homebuyers’ Perspective

For homebuyers, rising mortgage rates—reaching an average of 5.53%—posed significant affordability challenges, especially for entry-level buyers. Higher average and median property prices further narrowed access to homes in lower price ranges. However, the market offered notable opportunities, particularly in the availability of new construction homes, with 249 properties catering to those seeking modern designs and updated features. The increase in homes with pools also provided buyers the chance to invest in lifestyle-focused properties. With the average Days on Market (DOM) dropping to just 21 days, the market became highly competitive, reinforcing the need for buyers to act decisively and prepare strategically to secure desired properties before they sell.

Home-Sellers’ Perspective

For home-sellers, the 2022 market dynamics created substantial advantages. Average property prices soared by 18.5%, while the median price increased by over $50,000 compared to 2021, positioning sellers to gain significant returns. The faster pace of sales—reflected in the reduced DOM—meant well-priced, move-in-ready homes were in high demand. Sellers needed to carefully balance competitive pricing with market conditions to meet buyer expectations and maximize offers. Features like pools and larger properties resonated strongly with buyers seeking additional value, giving sellers of such homes an edge in the market. Meanwhile, the slight decline in new construction home sales hinted at an opportunity for resale properties to fill the gap in supply.

Both homebuyers and home-sellers in 2022 navigated a dynamic, fast-moving market influenced by economic shifts and changing priorities. Sellers enjoyed the benefits of increasing property values and brisk sales, while buyers had to overcome financial barriers but still found value in new developments and lifestyle-focused investments. The year emphasized the importance of preparation, understanding market trends, and adapting to the fast-evolving real estate environment.

The Importance of Statistical Data in Princeton, Texas Real Estate Market

Did you know that appraisers and Realtors rely on historical statistical data to determine a property’s current value?

Analyzing historical market data is essential for making informed decisions in today’s real estate market. Examining past trends provides valuable insights that facilitate accurate pricing, more strategic negotiations, and a comprehensive understanding of market dynamics. By understanding market dynamics, both homebuyers and home-sellers can leverage the conditions to achieve their goals.

Unlock Exceptional Service!

Assistance with all your real estate needs in the Dallas-Fort Worth area is just a click or call away. Reach out at 214-940-8149 or connect through the links below.

Greetings! I’m Oleg Sedletsky, and I’m excited to introduce myself as your go-to full-time licensed Texas REALTOR® and Mortgage Loan Originator.

I proudly represent JPAR® – Real Estate Brokerage as a REALTOR® and Utopia Mortgage LLC as a Mortgage Loan Originator! My designations and certifications reflect my dedication to helping you achieve your real estate goals in Princeton, TX and other locations in the vibrant Dallas-Fort Worth area!

My commitment to ongoing professional development means I’m always enhancing my skills to serve you better. You can count on me as your trusted expert throughout your real estate journey. Plus, I’m fluent in English, Ukrainian, and Russian and ready to assist you every step of the way!

It’s All About You and Your Real Estate Goals!

My mission is to serve you! With my knowledge and expertise, I’m here to help you achieve all your real estate goals!

I’m passionate about helping buyers and sellers navigate the exciting real estate landscape in Princeton, Texas! Whether you’re searching for your dream home, exploring land options, or looking for commercial properties, my Real Estate Services have you covered.

Contact me today for all your real estate needs in Princeton, Texas! Call/text 214-940-8149

A Comprehensive Analysis of Single-Family Residential Housing Market in Princeton, TX: 2010 to Present

Discover the trends, stats, and insights shaping Princeton’s real estate market year by year!

2010-2020

Princeton, TX Real Estate Market Report 2010: Analysis and Trends

Princeton, TX Real Estate Market Report 2011: Analysis and Trends

Princeton, TX Real Estate Market Report 2012: Analysis and Trends

Princeton, TX Real Estate Market Report 2013: Analysis and Trends

Princeton, TX Real Estate Market Report 2014: Analysis and Trends

Princeton, TX Real Estate Market Report 2015: Analysis and Trends

Princeton, TX Real Estate Market Report 2016: Analysis and Trends

Princeton, TX Real Estate Market Report 2017: Analysis and Trends

Princeton, TX Real Estate Market Report 2018: Analysis and Trends

Princeton, TX Real Estate Market Report 2019: Analysis and Trends

Princeton, TX Real Estate Market Report 2020: Analysis and Trends

This market analysis is intended solely for educational purposes. This market analysis is based on data sourced from NTREIS, Inc. This analysis is exclusively focused on single-family homes and does not account for other property types. The total number of real estate transactions within the specified period and location may vary. Data accuracy cannot be guaranteed due to potential input errors made by NTREIS users. This market analysis does not account for all new construction home sales. If you need detailed information about recorded property sales or other public records, please contact the appropriate city or county office.